EDC, Apprenti partner to grow local talent pipeline

The region’s manufacturing companies employ more than 116,000 skilled San Diegans who lead on the development and production of cutting-edge, life-changing technology. However, amid a nationwide talent shortage, companies everywhere are challenged to maximize their growth.

Through a new partnership between EDC and Apprenti, advanced manufacturers are invited to host registered apprentices in order to create a pipeline of critical talent and support the growth of the region’s workforce.

THE PARTNERS

EDC recognizes talent as the cornerstone of economic growth and works to leverage employer engagement, work-based learning, and unique company solutions to broaden San Diego’s pool of diverse, qualified talent. In complement, Seattle-based apprenticeship center Apprenti provides the resources to support employers in developing a strong apprenticeship pipeline. Through this partnership catalyzed during EDC’s 2023 Leadership Trip, talent is sourced, assessed, trained, and placed at participating manufacturing companies. EDC and Apprenti will also manage the administrative burden of registering through state and federal systems.

WHO SHOULD PARTICIPATE?

Program participants should operate in the advanced manufacturing space, with their workforce requiring technical skills without an advanced degree. These skills might include working with advanced technology, electrical and mechanical equipment, automated machinery, and foundational scientific concepts. Suitable companies can be from industries including consumer goods, life sciences, medical devices, and technology, among others.

WHY PARTICIPATE?

POTENTIAL TIMELINE

POTENTIAL TIMELINE

- Summer 2024: Apprentices begin training in the classroom part time and working part time on the job.

- Winter 2026: Apprentices complete classroom training, apprenticeship ends, and employers bring individuals on full time at full salary.

COST

- EDC investors: $3,000 per apprentice

- Non-investors: $3,500 per apprentice

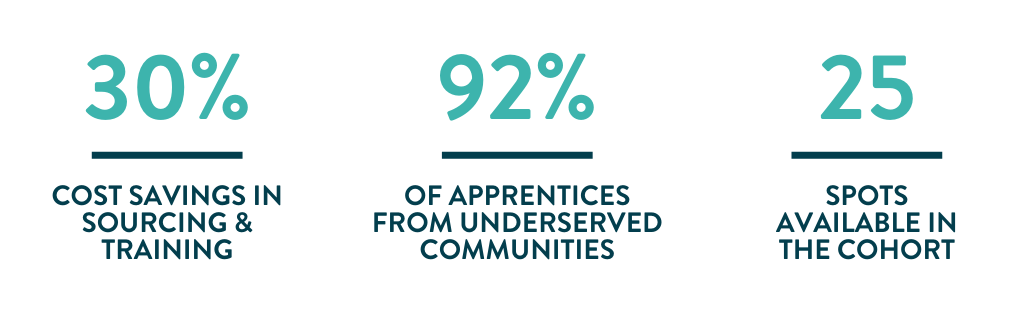

The price covers services provided by Apprenti and EDC in sourcing talent, conducting aptitude tests, completing state and federal administrative requirements, providing ongoing apprenticeship programmatic support, and coordinating with training partners around funding and qualified curriculum. It does not include the cost of related coursework (which could be as low as $0) nor wages for the apprentice(s), which must be at least 60 percent of the average wage paid to other individuals in the same role at your company.

To learn more or join the cohort, contact:

Taylor Dunne

Director, Talent Initiatives