Welcome to the final edition in EDC’s Changing Business Landscape Series, which is published bi-monthly in the San Diego Business Journal and here on our blog. If you missed them, check out all past editions here.

Surveying the changing business landscape in San Diego

The COVID-19 pandemic has impacted every facet of life, including how businesses operate. Companies in every industry are rapidly re-evaluating how they do business, changing the way they interact with customers, manage supply chains and where their employees are physically located. This has massive immediate and long-term implications for San Diego’s workforce and job composition, as well as regional land use decisions and infrastructure investment.

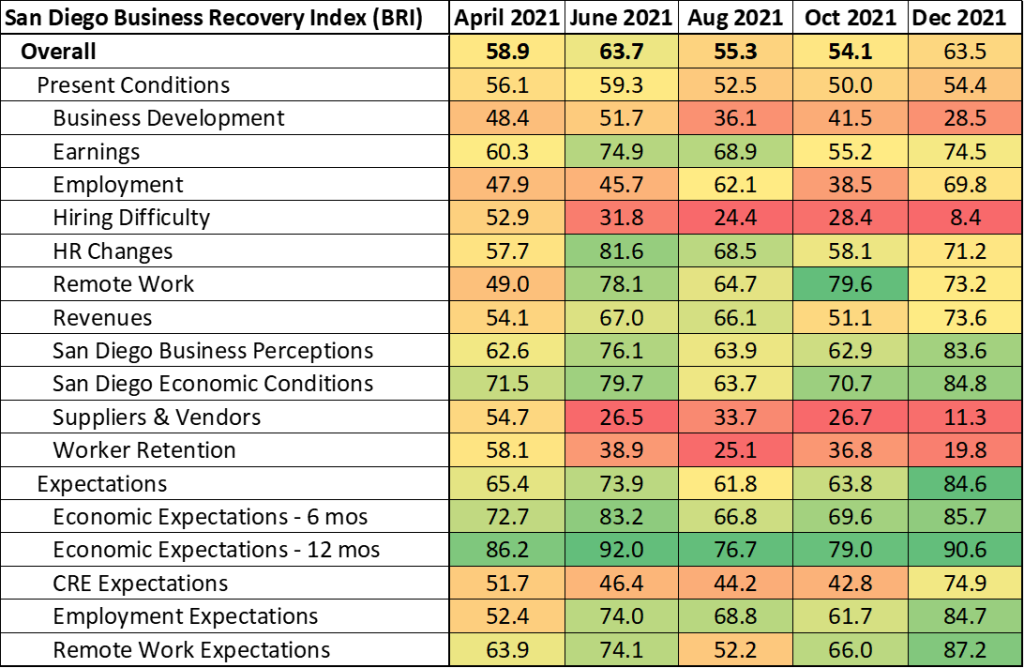

To identify evolving trends in local business needs and operations, ensuring their ability to grow and thrive in the region, San Diego Regional EDC surveyed nearly 200 companies in the region’s key industries on a rolling basis throughout 2021 to monitor and report shifts in their priorities and strategies. In addition, EDC constructed the San Diego Business Recovery Index (BRI)—a sentiment index to measure companies’ perceptions of current conditions, as well as expectations for the future across several factors such as business development, employment and commercial real estate needs. (An index value >50 reflects expansion, and a value <50 reflects contraction. More information on the index and how it is calculated is available at sandiegobusiness.org/research.)

These insights will help inform long-term economic development priorities around talent recruitment and retention, quality job creation, and infrastructure development. Companies are surveyed on several topics, with varying emphases in each wave.

Here are three key findings from the final wave of surveying conducted in December 2021:

- Companies have settled into their pandemic modes of operation. Revenues and employment have stabilized, driving positive sentiment of San Diego’s current business environment.

- Pandemic-driven challenges aren’t going away soon. Businesses report greater struggles with hiring, retention, and supply chain disruptions than at any other point in 2021.

- Businesses enter 2022 with a renewed level of optimism. The challenge will be in meeting industry’s growth with infrastructure investment needed to sustain it.

San Diego businesses reported mainly positive views on both the current conditions and expectations for region’s economy during the next six to 12 months. Although there was significant variation in these sentiments depending on the size of establishment, the overall results of December’s Changing Business Landscape survey were positive. The BRI climbed 9.4 points from 54.1 in October to 63.5 in December, reflecting more positive views of current economic conditions as well as much more bullish view of the future.

Companies have settled into their pandemic modes of operation

Across firm size and industry, business perceptions are that San Diego’s economic engines have adapted better than peer metros in the United States during the pandemic. As new coronavirus variants continue to surface, this adaptability is paramount to the continued success of the region’s businesses, both large and small. Furthermore, businesses rated San Diego’s economic health higher in December than at any other point in the year.

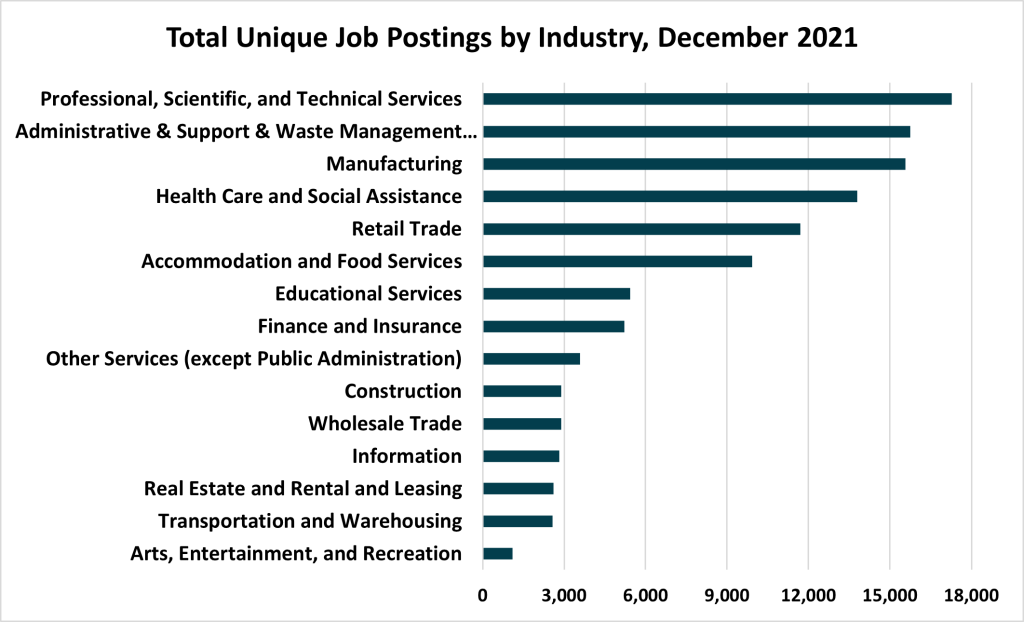

The biggest driver behind the rosy views of current business conditions surrounds employment, with San Diego businesses indicating that they have significantly increased their workforce since the start of the pandemic. This is principally driven by innovation industries, such as Life Sciences and Manufacturing. Life Sciences companies, in particular, are growing rapidly, raising $5 billion in venture capital funding in 2021 alone.

Along with growing payrolls, San Diego businesses are also reporting a rebound in both revenues and earnings. However, the magnitude of the rebound varies by business size. Businesses with fewer than 50 employees reported milder up swings (BRI values in the low-50s) compared to businesses with more than 250 employees (BRI values in the mid-70s). Here again, Life Sciences and Manufacturing led the way. However, some surprising results came from Software companies which reported declines in both revenues and earnings back in October. This could also be attributable to a surge in venture funding during the fourth quarter of 2021.

Finally, business leaders appear to have adapted to the constant disruption from new coronavirus variants and we enter the third year of a pandemic. More are reporting additional changes to their human resource policies and related procedures to operate effectively, and satisfaction with remote work arrangements remains high.

Pandemic-driven challenges aren’t going away soon

The employment gains reported by companies have not come easily. Employers indicated that hiring difficulty has reached a new low with December’s BRI at a dismal 8.4, a massive drop from October’s already low level of 28.4. Not only are the region’s businesses spinning their wheels over ever-increasing difficulty hiring, but a new record rate of workers quitting across the U.S. has made the war for talent a two-front war. San Diego entered 2021 with more than 122,000 people unemployed. Over the course of the year that number has fallen by half and while there is technically surplus of workers in the region, demand for workers is even greater. In fact, during the month of December employers posted more than 158,000 unique jobs—nearly half of which are new positions. Nearly every industry is in need of more workers and the demand is translating into higher advertised salaries.

In addition to their troubles recruiting and retaining talent, San Diego businesses reported a sharp decline in their ability to manage suppliers and vendors as the global supply chain knot continues to disrupt normal business operations. These issues appear to be worse for larger companies, as they often require intermediate inputs from international vendors in larger quantities than smaller businesses, making it more difficult to find new suppliers when there is a delay in production or shipping. Despite these disruptions, San Diego’s transportation cluster continues to grow. This is important because it supports more than 90,000 local jobs while propelling San Diego’s global competitiveness.

Businesses enter 2022 with a renewed level of optimism

Businesses reported strong future expectations across every single forward-looking BRI segment in December. Notably, San Diego companies with more than 250 employees once again expect to lease or purchase additional commercial space in the next six to 12 months after expressing desires to reduce their collective footprint in October. Here again, medical device manufacturers, and manufacturers more broadly, are driving the trend. Additionally, expectations for future remote work were strongest in December by a large margin. Companies of all sizes and industry have embraced remote work, to some degree, as a part of how they operate going forward.

While the impacts of omicron are not necessarily captured during the last wave of surveying, businesses nonetheless feel that San Diego has fared well in adapting to changing regulations and continuous staffing and supply chain uncertainties. If this is, in fact, the next normal, San Diego’s economic engines are well positioned to drive that growth.

While businesses surveyed leave 2021 with a renewed sense of optimism, 2022 will bring more questions than answers. Will remote work and a continually rising cost of living begin to drive talent away? Will the ‘great resignation’ translate into surge of new startups? Will record venture capital prove to be circumstantial or drive a new Life Sciences boom? Will the billions of dollars of public funding from the state align to support growth? EDC will be monitoring these trends and how companies continue to adapt in the face of an ever-changing business landscape.

For San Diego to fully emerge from this global pandemic, it must reconcile an economic recovery that is full of contradictions. The region is simultaneously experiencing strong job growth and eye-watering venture capital investment, along with widespread labor shortages, small business closures, and a housing market that is nearly 30 percent more expensive. Moreover, these impacts were not felt evenly across the region. The brunt of the adverse health and economic impacts of the pandemic were incurred by low-income earners and people of color.

The past year was one of adaptation and endurance, but also a year that reinforced the need to focus on the fundamental building blocks of a strong economy—quality jobs, skilled talent, and thriving households. The next year will be one where resilience means connecting more people to innovation industries; competitiveness means more San Diegans have the skills the economy needs; and prosperity means that working families can afford to live here. More than ever, smart economic development means inclusive economic development.

For more data and analysis, visit our research page.

This research is made possible by: