Presented by Meyers Nave, this edition of San Diego’s Data Bites covers March 2022, with data on employment and more insights about the region’s economy at this moment in time. Check out EDC’s Research Bureau for even more data and stats about San Diego.

KEY TAKEAWAYS

- San Diego employers added 8,000 nonfarm payroll positions between February and March, lowering the unemployment rate to 3.4 percent from a revised 4.0 percent from one month ago.

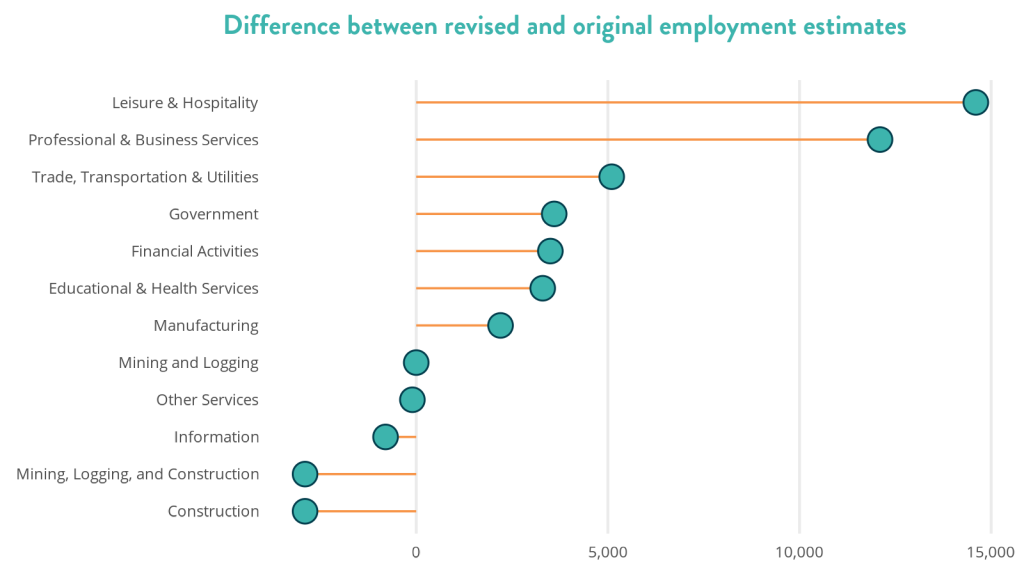

- Compared to March 2021, total nonfarm employment increased by 103,600, or 7.4 percent. 49,900 additional jobs in Leisure and Hospitality led year-ago employment gains, with Professional and Business services adding 20,600 positions.

- Employment in San Diego lags pre-pandemic levels by only 14,000 jobs, with Leisure and Hospitality accounting for 9,000 missing payroll positions. However, industries in San Diego’s innovation economy are well ahead of where they were before COVID-19.

Unemployment rate drops below four percent in March 2022

The March employment report showed that San Diego establishments added 8,000 nonfarm payroll positions compared to February, with 5,000 of these jobs in Leisure and Hospitality. State and Local Government was the next-closest industry experiencing employment gains, with 2,000 additional jobs. These additions to San Diego’s economy drove the unemployment rate lower by 0.6 percentage points, from a revised 4.0 percent in February to 3.4 percent in March.

Health Care and Social Assistance lost the most jobs between February and March, dropping 1,300 payroll positions. Although Ambulatory Health Care Services accounted for 1,100 of the lost jobs, the industry employed more people in March 2022 compared to pre-pandemic levels in February 2020. These lost jobs could be the result of lower transmission and infection rates of COVID, requiring fewer employees to manage workloads.

Leisure and Hospitality continues to lead year-ago employment gains

Overall, San Diego employers added 103,600 nonfarm payroll positions from March 2021 to March 2022. Leisure and Hospitality accounted for 49,900 of these jobs, which is not surprising considering that companies in this industry cluster were the hardest hit by the pandemic. The fact that businesses engaged in Accommodation and Food Services are adding more jobs with each new jobs report is a sign that San Diego is recovering well from the troughs of the pandemic.

Furthermore, not a single one of the industry clusters that the EDD tracks (e.g. Leisure and Hospitality and Professional and Business Services) showed year-ago jobs losses, providing further evidence of the steady recovery of San Diego’s economy back to pre-pandemic levels. Professional and Business Services added 20,600 positions to San Diego’s economy, a 7.9 percent increase over last year’s levels. As part of San Diego’s innovation economy, industries such as Scientific Research and Development Services tend to be comprised of quality jobs, those that offer economic security by paying a wage that keeps up with the cost of living and providing employer-sponsored health benefits. Some sub-industries, however, did shed jobs compared to a year ago, such as Nursing and Residential Care Facilities (down 2,300 jobs) and Durable Goods manufacturing (down 2,000 jobs).

Employment in San Diego lags pre-pandemic levels by only 14,000 jobs

San Diego’s total nonfarm employment ended March 2022 at 1,501,100 jobs, which is 14,000 shy of pre-pandemic levels in February 2020. Although employment in Leisure and Hospitality is still 9,000 jobs lower than before COVID-19, this industry cluster has consistently led the pack in each monthly jobs report, meaning that pre-pandemic levels are just within reach. This is a strong indicator of the region’s economic recovery and health, as Accommodation and Food Services companies were the hardest hit by the pandemic.

Employment in other industry clusters, including those that drive San Diego’s innovation economy, has already surpassed pre-pandemic levels. Professional and Business Services has added almost 20,000 positions to the region’s economy from February 2020, with 7,300 of these jobs belonging to Scientific Research and Development Services. Jobs in these industries often have a high concentration of high paying quality jobs. The record year that San Diego experienced with respect to venture capital—especially in Tech and Life Sciences companies—should result in even more hiring by these companies throughout 2022.

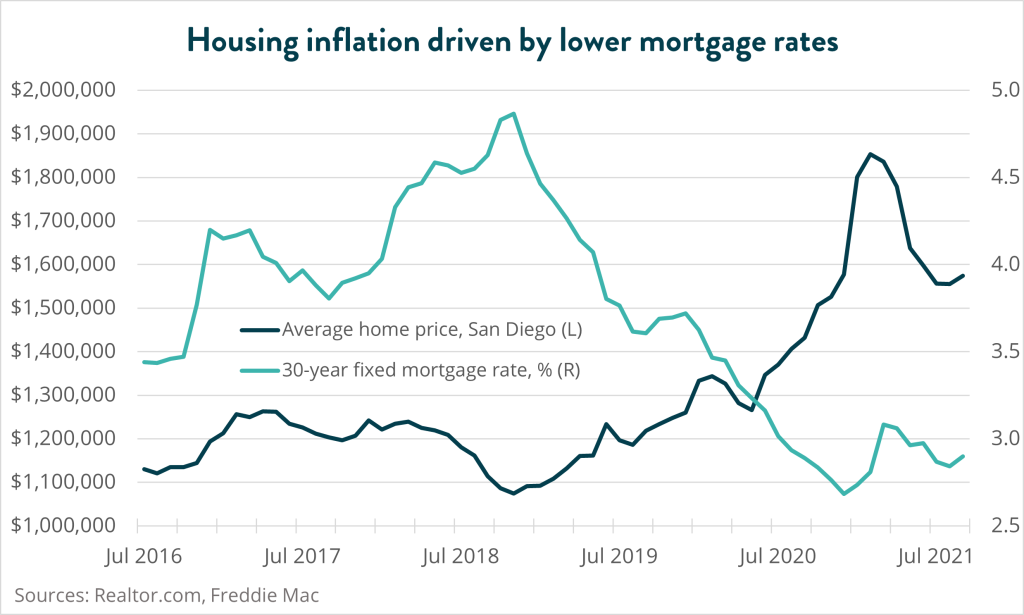

However, the economic stimulus over the course of the pandemic has resulted in the highest inflation seen for quite some time, with the 12-month inflation rate reaching 8.5 percent in March. This led the Federal Reserve to hike interest rates by 25 basis points, with expectations of more to come. These expectations have translated into a decreased appetite for borrowing and investment, slowing the record pace at which San Diego is attracting venture capital dollars.

In fact, investment in Series A, seed, angel, and growth stages totaled just over $1 billion in Q1 2022, a far cry from the $2.7 billion in Q1 last year. Though the rate at which money is flowing into San Diego Tech and Life Sciences companies is slowing, the region will feel the ripple effects of the record-setting year in 2021 for some time to come. For example, the current demand for lab space in San Diego County is triple the amount of new deliveries that are expected in the next 12 months. As these Life Sciences companies move into new commercial space in the region, they will need to hire for newly created positions, many of which are high-paying quality jobs.

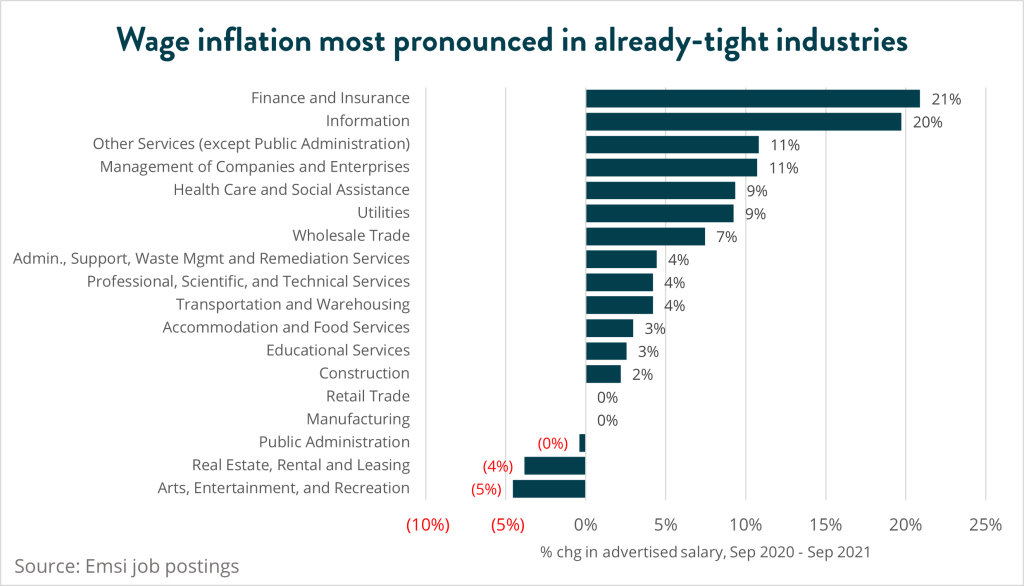

However, San Diego companies across all industries are engaged in a bitter competition for talent. Not only do high levels of inflation make San Diego a more expensive place to live, but a white-hot housing market has sent home prices through the roof, with the median home price reaching $950,000 in March, a 19 percent increase from one year ago. This high cost of living in San Diego is a tax that deters talent from staying in or relocating to the region. By addressing San Diego’s affordability crisis and building San Diego’s talent pipeline, employers can do their part to bolster the region’s resiliency and global competitiveness.