Dear EDC investors and partners,

Last month, EDC’s Vice President of Economic Development and Research Eduardo Velasquez reminded us that San Diego stands at an inflection point—where technological transformation is colliding with long‑standing economic challenges in ways previously unseen. His note highlighted a region defined by promise and pressure: Slowing innovation‑sector job growth, rising household incomes shadowed by affordability constraints, and AI reshaping the very nature of work.

A month into 2026, more questions than answers remain, especially when it comes to talent: What is the role of post-secondary education in our changing region? How is AI shifting jobs and industries? And what does this mean for San Diego’s early career talent, our region’s leaders of tomorrow?

Built on talent—but facing new realities

San Diego’s economic engine has always been its people. With more than 100 research and education institutions, our region has long produced the skilled talent that fuels innovation, defense, life sciences, and advanced manufacturing.

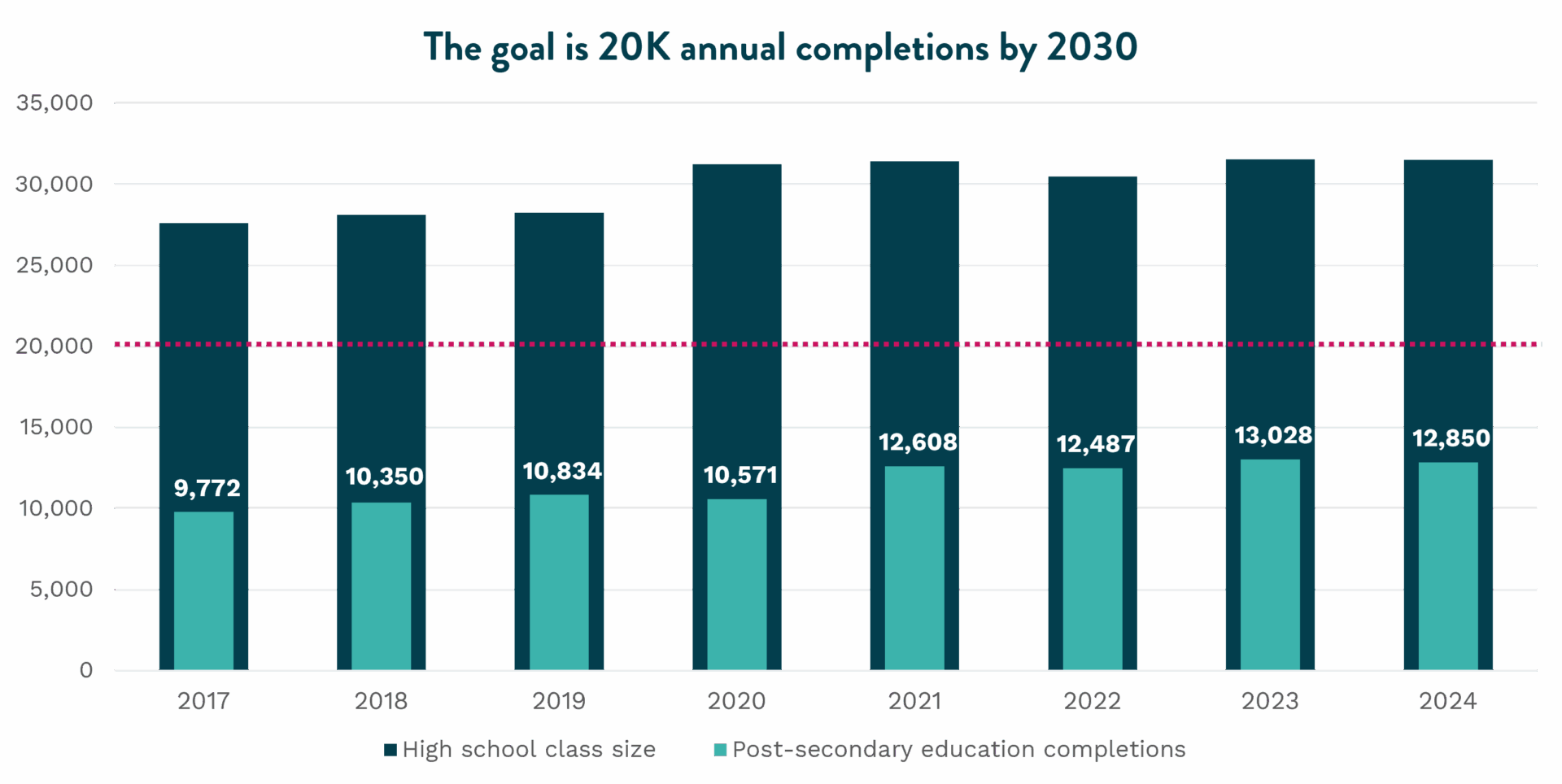

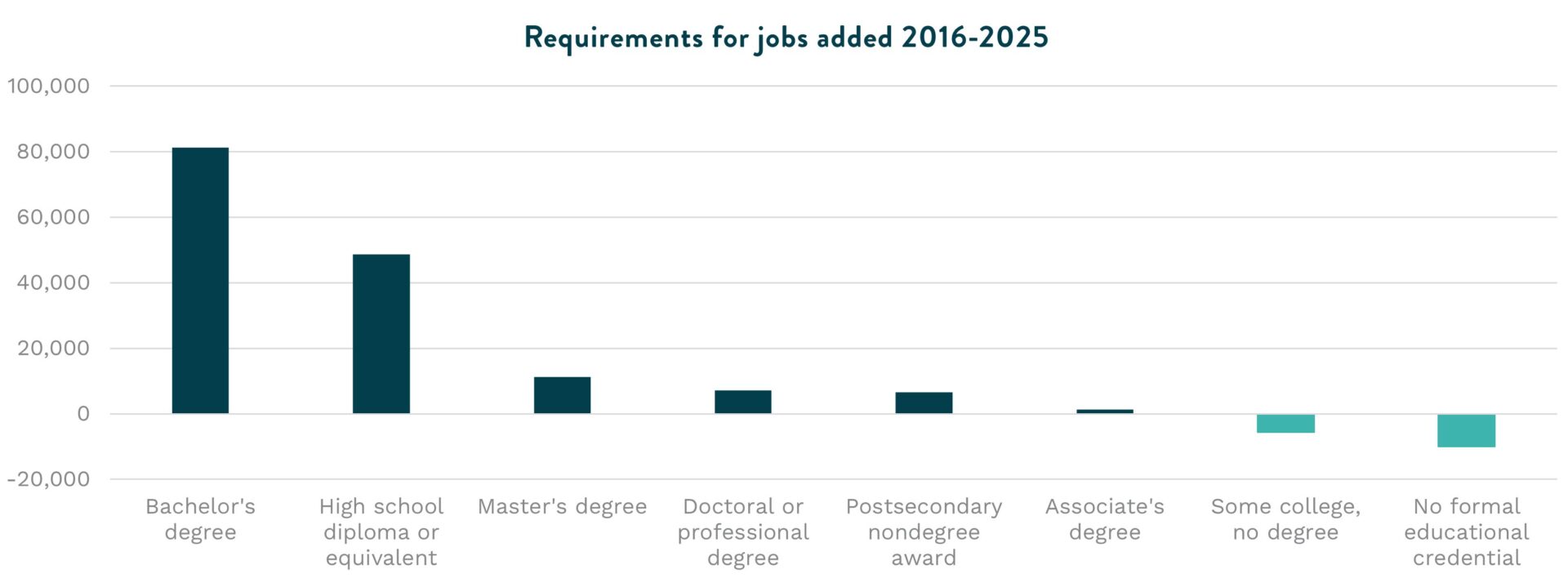

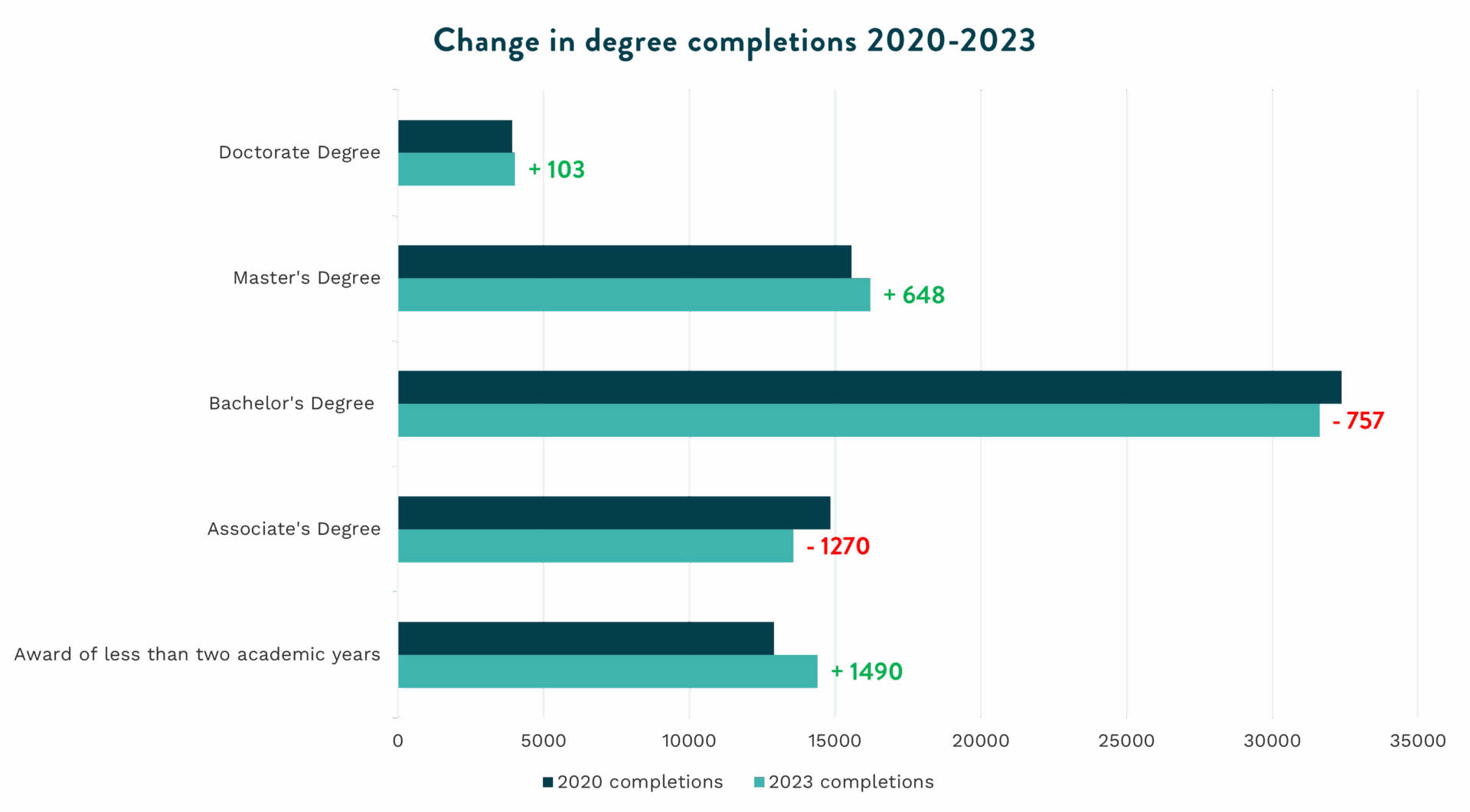

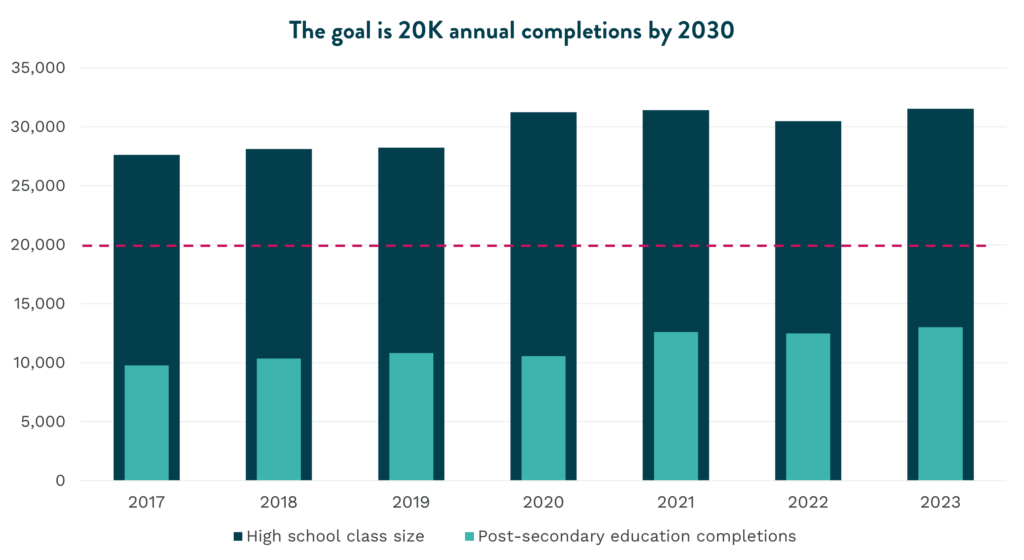

The good news: More San Diego students are completing degrees and credentials than ever before. The region has sustained progress in completions, even as the pandemic’s long‑term impacts remain murky. But the data also makes one thing clear: Post-secondary education is more critical than ever. Jobs requiring a bachelor’s degree or higher continue to grow at a significantly faster rate than those requiring less education. In fact, in 2025, San Diego added six times more jobs requiring a bachelor’s degree or more versus those requiring an associate degree or less.

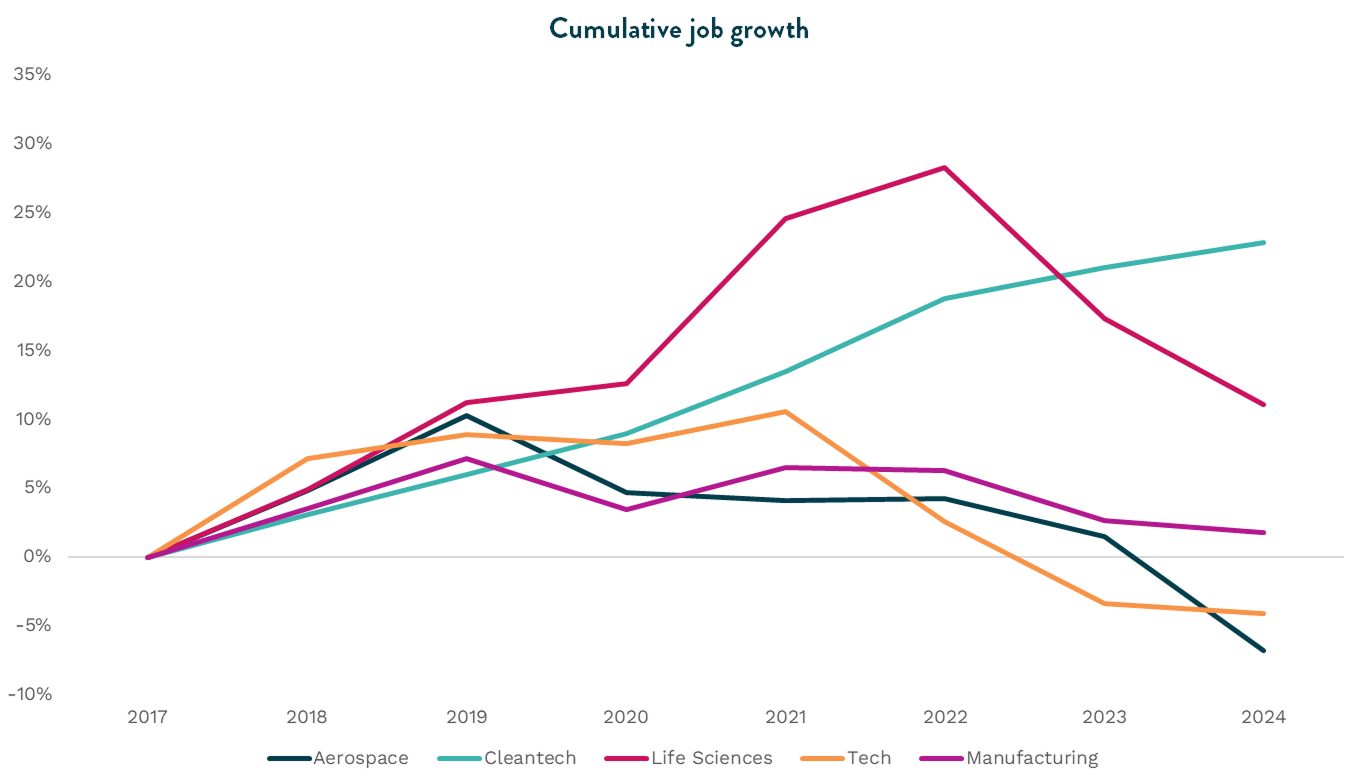

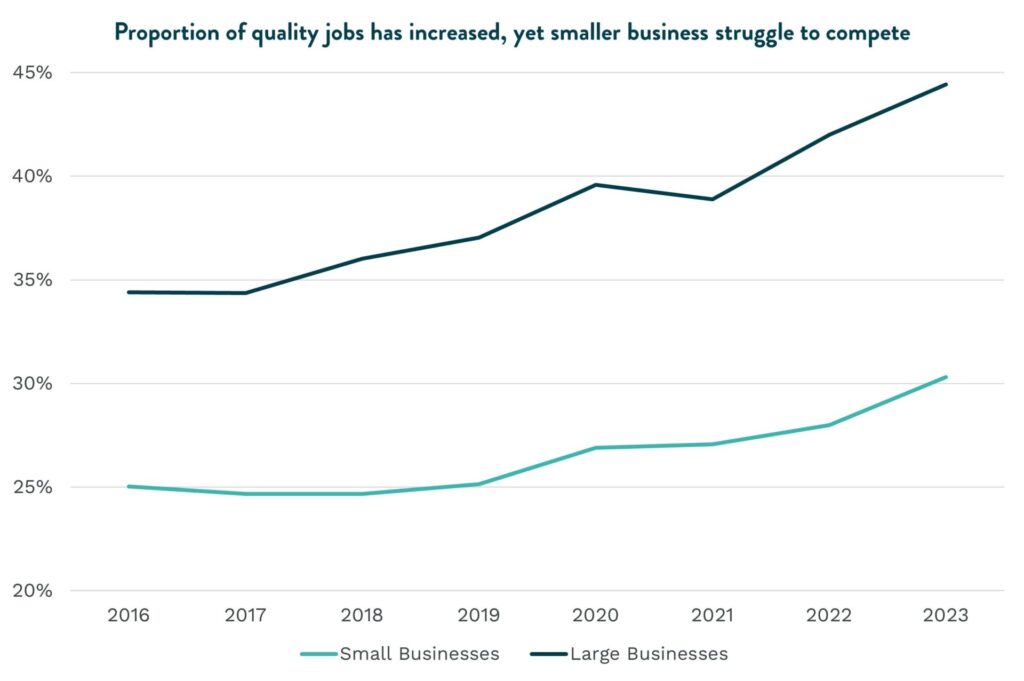

Additionally, the growth of legacy industry clusters that have served as the backbone of San Diego’s global competitiveness—tech, life sciences, and manufacturing—is slowing down. While bright spots remain in emerging industries like cleantech and aerospace (namely defense technology) that are critical to the region’s future competitiveness, transformations in these industries and varied levels of AI integration represent significant changes to the entire U.S. economy. Their effects will ripple throughout the whole workforce.

Take the cleantech industry, for example, as policy-backed efforts to decarbonize in California are leading to more electrification. As buildings modernize, we might expect increased need for electricians, while the need for gas-line plumbers decreases. The auto mechanic historically focused on combustion engines must now become familiar with hybrid and electric motors. And the manufacturing company that embeds machine learning and automation now requires a person who can analyze and tell a story with the resulting data.

A future workforce that doesn’t yet see a future

Across the U.S., young college‑educated workers are facing a “unique convergence of structural forces” that have severed traditional entry points into white‑collar work.

AI is accelerating this shift. Automation and augmentation are happening within jobs, not just across them. The occupations where automation potential is high are the same ones where augmentation potential is high—meaning AI may not necessarily eliminate an occupation, but rather transform how an employee executes their tasks.

With lower barrier to entry tasks most exposed to automation, the entry-level or new graduate workforce risks being edged out of opportunities to launch. Meanwhile, the nature of the tasks exposed to augmentation will require mid-level workers to continue upskilling to remain competitive.

As for long-term impacts? It’s too early to tell. San Diego’s labor market data does not yet reflect an overhaul of entry-level roles. Job growth across innovation industries at all levels has declined over the last few years, and while entry-level job growth has declined slightly faster, it has not been the job elimination of our nightmares.

What remains constant in our conversations with employers across industries and occupations is a need for soft skills that will never be automated. Skills like communication, empathy, and problem solving are more fashionable than ever. In fact, this demand has been so persistent that workforce developers and educators have taken to calling these “durable” skills—though figuring out how best to cultivate them in students may be the next great challenge.

In a time of transitioning tech, too, regional employers are doubling down on opportunities to future-proof their workforce. We’ve heard from San Diego companies that are making a deliberate effort to traditionally train early career employees in the skills AI could support, both to strengthen institutional knowledge and develop future leaders. And local tech heavyweights are continuing to proactively invest in both tomorrow’s talent and technology, maintaining internship programs that convert as many as three in four interns to full-time roles and leveraging new technologies early to instill technical skills in the emerging workforce.

Lean in with us

To meet these challenges, EDC is doubling down on initiatives that align education, industry, and talent. Through regional and even national partnerships, we will continue to facilitate work-based learning like internships and apprenticeships, and equip the region to better understand its labor market needs.

Here’s how you can lean in:

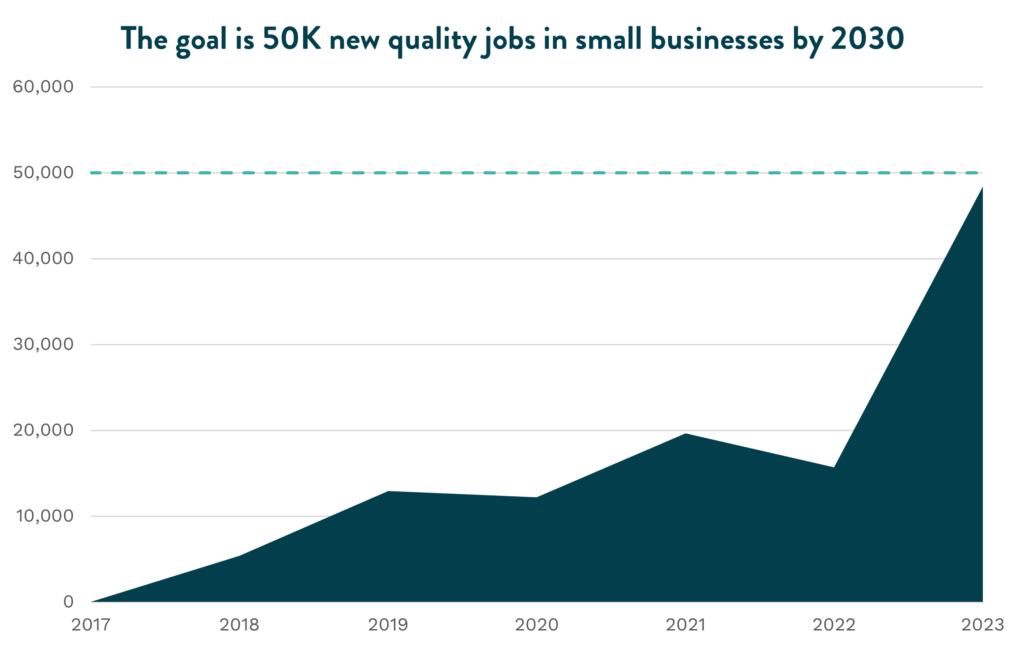

- Host a summer intern from a Verified Program: All intern hosts will work with an employer of record and have access to a pre-vetted batch of resumes. Small businesses may qualify for interns’ wages to be subsidized or fully covered. Learn about our Advancing San Diego internship program.

- Hire from Verified Programs in San Diego: These local programs are employer-verified for teaching in-demand skills as well as serving a diverse student population. To connect with a Verified Program, reach out to EDC.

- Help us collect critical regional talent data: With so many remaining questions, it has never been more important for training and education institutions to keep a pulse on future talent demand. Our talent data dashboard, annual talent survey, and talent demand reports help local education programs prepare San Diegans with the skills your company needs. If your company is experiencing shifts in talent needs, we want to hear about it.

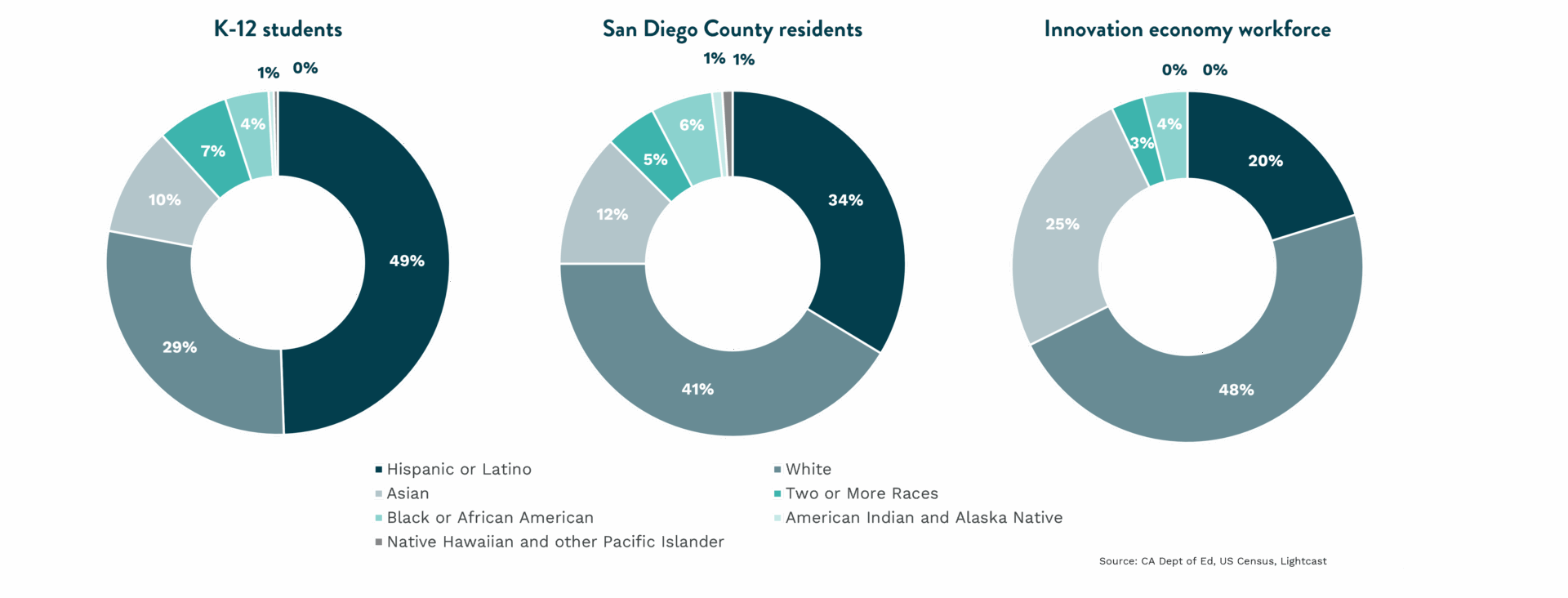

San Diego’s future workforce is diverse, ambitious, and full of potential—but only if we build the systems that allow every resident to participate in and benefit from our innovation economy.

Your collaboration and investment—whether through hiring, training, curriculum partnerships, or direct support of EDC initiatives—continues to ensure that San Diego can cultivate the talent that creates, attracts, and retains cutting‑edge companies, strengthens our innovation clusters, and secures San Diego’s economic future.

Taylor Dunne

Director, Talent Initiatives