Each quarter, EDC’s Research Bureau releases its Economic Snapshot to analyze key economic indicators in San Diego’s economy. Read on as we dig deeper to assess the region’s labor force, unemployment, and talent supply.

As 2022 came to a close, San Diego celebrated a relatively low unemployment rate at three percent. However, across just a few months, the region saw a slight bump up to four percent in the second quarter of 2023. What does this increase signify, and why is it essential to comprehend the broader employment landscape in San Diego?

Understanding San Diego’s labor force involves more than just examining unemployment rates. It requires considering historical context, peer metro comparisons, labor force dynamics, seasonal trends, and the complex factors shaping employment and workforce trends.

San Diego’s unemployment rate has hovered between 2.9 percent and four percent over the past five years, with the exception of the pandemic-induced peak of 13.6 percent. Since then, San Diego’s unemployment rate has been steadily declining until its first increase in Q1 2023.

With this context in mind, here are some different ways we approach the data.

HOW SAN DIEGO STACKS UP

To gain a comprehensive understanding of local employment, we compare San Diego’s numbers with its peer metros and the nation. In the first two quarters of the year, the U.S. and our peer metros saw an increase in unemployment rates after continuously declining throughout 2022. See how San Diego stacks up in our interactive dashboard, where you will notice similar trend lines in most comparisons. Still, the region ranked amongst the highest increases in this national trend, following Riverside, St. Louis, and San Francisco.

‘TIS THE SEASON

Employment in specific industry sectors can fluctuate due to seasonal factors. For instance, in Q2 2023, tourism and hospitality experienced an expected seasonal spike of 7,100 jobs as San Diego prepares to receive tourists in the spring. To account for these fluctuations, analysts often examine the percentage change from the previous year. In Q2 2023, there was a three percent growth in employment compared to the previous year, slightly exceeding the typical annual employment growth rate (ranging between 1.2 and 2.5 percent) and indicating anticipated recovery from the pandemic.

BREAKING DOWN THE LABOR FORCE

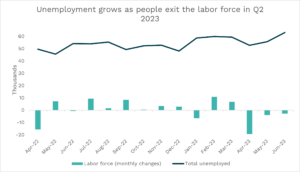

One crucial aspect to consider when analyzing rising unemployment rates is the overall labor force composition. Sometimes, an increasing unemployment rate can be attributed to a growing labor force as individuals re-enter or join the workforce. This usually results in temporarily higher unemployment rates, as these individuals search for employment and the hiring process takes time. However, for Q2 2023, this was not the case. Data indicates a decline in the total labor force while the number of unemployed has risen. This phenomenon contributed to the increase in the unemployment rate during the first half of 2023. To put this into perspective, Q2 2023 saw a labor force decline of 25,889 since the last quarter. In contrast to the year before, the labor force declined by 8,966 in Q2 2022. While historical data indicate that labor force declines at the beginning of Q2 are typical, this year’s Q2 decrease marked the highest in the past five years, even exceeding Q2 2020 when employment was first affected by the pandemic.

WHY THE CHANGE?

Here are some factors that can collectively help explain San Diego’s labor force fluctuations:

Remote work trends. The widespread adoption of remote work during the pandemic has led to a preference for flexibility and convenience. As a result, workers may seek remote-only or hybrid work arrangements, potentially contributing to the “great resignation” phenomenon. This trend also has implications for the use—or lack thereof—of office space and commercial real estate. Office asking rates have remained high after the pandemic spike ($3.26 per square foot), while rates for industrial space have been more stable.

Rising cost of living. While San Diego is home to top universities producing talent in key economic sectors such as innovation, the increasing cost of living may drive workers away from the region. EDC’s Inclusive Growth framework highlights the disconnection between the unaffordable housing market and compensation. Competitive wages are a must to keep our locally produced talent in the region.

Limited talent supply. There are more open positions in San Diego than unemployed people available to fill them—on par with the national trend. Employers are responding to talent supply challenges by prioritizing inclusive talent recruitment. Job opportunities are opened to a new subset of the unemployed population, expanding the talent pool for employers. To do this, there have been employer-driven efforts to reevaluate training requirements and accessibility, as well as amplified focus on opportunity populations. On the educators side, efforts are being made to leverage the bi-national comparative advantage to fill high-demand positions with talent produced in the Baja region by collaborating with universities across the border. UC San Diego’s ENLACE summer research program invites high school and university students from the Baja region to participate in research programs at UC San Diego.

While the unemployment rate itself is not always sufficient to indicate concern, historical economic context and analysis helps us gather the following takeaways:

- High-level unemployment numbers for Q2 2023 are in alignment with historical and national trends, as most peer metros experienced similar increases. In other words, San Diego is not experiencing any unusual trend activity.

- However, labor force composition trends should command our attention in upcoming quarters, being that Q2’s labor force number decreased significantly compared to the past five years.

- Total labor force and unemployment numbers are particularly important to track given the region’s talent supply. Lower unemployment rates can generally indicate a limited talent pool; however, this quarter’s unemployment rate increase was mostly due to people exiting the labor force, not people joining and looking for jobs.

Explore the data in our Economic Snapshot.