Today, EDC released the first-ever economic impact report on San Diego’s genomics industry. “Cracking the Code: the Economic Impact of San Diego’s Genomics Industry” explores the economic factors that have led to the proliferation of San Diego’s genomics industry, analyzes the region’s genomics standing relative to other U.S. regions, and quantifies San Diego’s genomics-related firms, talent pool, venture capital and more.

Today, EDC released the first-ever economic impact report on San Diego’s genomics industry. “Cracking the Code: the Economic Impact of San Diego’s Genomics Industry” explores the economic factors that have led to the proliferation of San Diego’s genomics industry, analyzes the region’s genomics standing relative to other U.S. regions, and quantifies San Diego’s genomics-related firms, talent pool, venture capital and more.

As the #1 most patent intensive genomics market in the U.S., San Diego is leading the charge in a new era of healthcare. Personalized medicine and technology are taking precedence, with local genomics companies, research institutions and universities at the forefront.

KEY FINDINGS

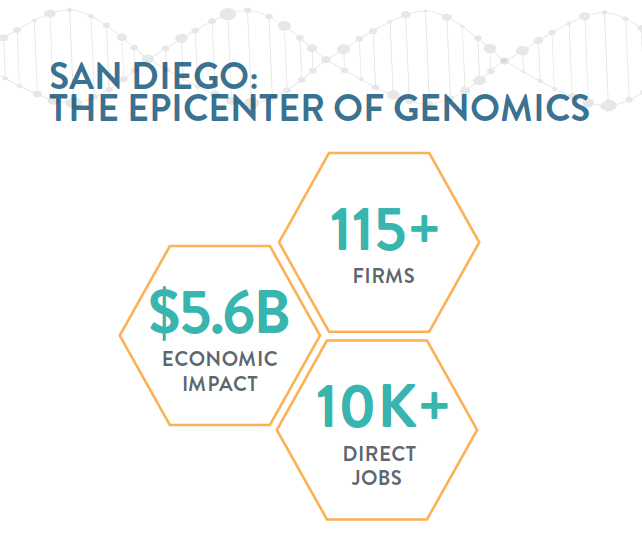

Leadership: San Diego is poised to continue its leadership in the field of precision medicine. With more than 115 genomics-related firms, San Diego has companies that handle every aspect of the genomics value-chain – from sampling and sequencing (e.g. Illumina, Thermo Fisher Scientific) to analysis and interpretation (e.g. AltheaDX, Human Longevity, Inc.) to clinical applications (e.g. Celgene, Arcturus Therapeutics), creating a complete ecosystem. Additionally, San Diego conducts the fundamental scientific research, due in part to the concentration of research institutes, that form the basis for many global genomics therapies and interventions.

Capital: While San Diego is home to just one percent of the U.S. population, it received 22 percent – $292 million – of the venture capital funding in genomics in 2016. Continually, San Diego’s numerous nonprofit research institutes command a large share of federal funding (e.g. NIH). In fact, San Diego received $3.2 million federal contract dollars in 2016 – more than any other U.S. region.

Talent: San Diego produces more genomics-ready graduates, relative to the size of its workforce, than any other U.S. region. With nearly 2,000 average genomics-related degrees (biochemistry, cognitive science and bioinformatics) conferred per year, San Diego’s genomics companies benefit from the preparatory work of the region’s top academic institutions. In that vein, it is projected that the local talent pool for key genomics occupations will grow by an additional 10 percent by 2021.

ADDITIONAL KEY FACTS

- San Diego’s genomics industry has a $5.6 billion annual economic impact, impacting 35,000 jobs in 2016.

- Among top life sciences U.S. metros, San Diego’s genomics industry ranks #2 overall, #3 in innovation, #2 in talent, and #4 in growth.*

- From 2014 to 2016, San Diego generated 371 genomics-related patents. Collectively, 28 local firms generated 120 genomics-related patents in 2016.

- San Diego is 3.1x more concentrated than the U.S. in key genomics occupations.

- From 2011 to 2016, San Diego’s genomics talent pool grew by 11 percent, far outpacing the national growth rate of 5.1 percent.

*The genomics scorecard was calculated using a weighted ranking system divided into three categories approximating the genomics ecosystem: innovation, talent, and growth.

EDC’s study was underwritten by Illumina, and sponsored by Alexandria Real Estate, Barney & Barney, Biocom, Eastridge Workforce Solutions, Human Longevity, Inc., Latham & Watkins, Thermo Fisher Scientific and UC San Diego. Additional research support was provided by CBRE.