Each month the California Employment Development Department (EDD) releases employment data for the prior month. This edition of San Diego’s Economic Pulse covers April 2020 and reflects some effects of the coronavirus pandemic on the labor market. Check out EDC’s research bureau for more data and stats about San Diego’s economy.

Unemployment Skyrockets

The region’s unemployment rate was 15.0 percent in April, up from a revised 4.2 percent in March 2020, and above the year-ago estimate of 2.9 percent. During the 2009 recession, unemployment peaked at 11.1 percent in January 2010 and again in July 2010. The region’s unemployment rate remains lower than the state unemployment rate of 16.1 percent, but higher than the national unemployment rate of 14.4 percent during the same time period, respectively.

Employment Declines More than the Great Recession

Between March 2020 and April 2020, total nonfarm employment in San Diego decreased from 1,494,000 to 1,299,400, a loss of 195,000 jobs. For context, during the 2009 recession, the largest monthly non-seasonal job loss in San Diego was between June 2009 and July 2009, with 22,900 jobs lost, and the local economy lost a total of 119,000 jobs from Dec 2007 to Jan 2010. Put differently, more than 25 months of job losses occurred in San Diego in April alone because of COVID19. The month-over-month job losses are consistent with record-breaking state and national trends. In California, nonfarm employment decreased by 2.3 million in April from the month prior, and payroll employment declined by 20.5 million in the U.S. during the same time period.

According to the Bureau of Labor Statistics’ Current Population Survey, over 78 percent of all unemployed Americans in April reported being “on temporary layoff.” On the surface, this could mean that a sizable portion of those laid off will be able to get back to work in relatively short order. However, with many retail and food service businesses reopening at only partial capacity, the return to work may be longer than expected, and some who reported being on temporary layoff may ultimately be laid off permanently.

Compared to a year ago, San Diego nonfarm employment contracted by 199,200 jobs or 13.3 percent. In California, total nonfarm employment decreased by 2.3 million jobs, or 13.4 percent, from April 2019 to April 2020 compared to the U.S. annual loss of 19.4 million jobs, or 12.9 percent.

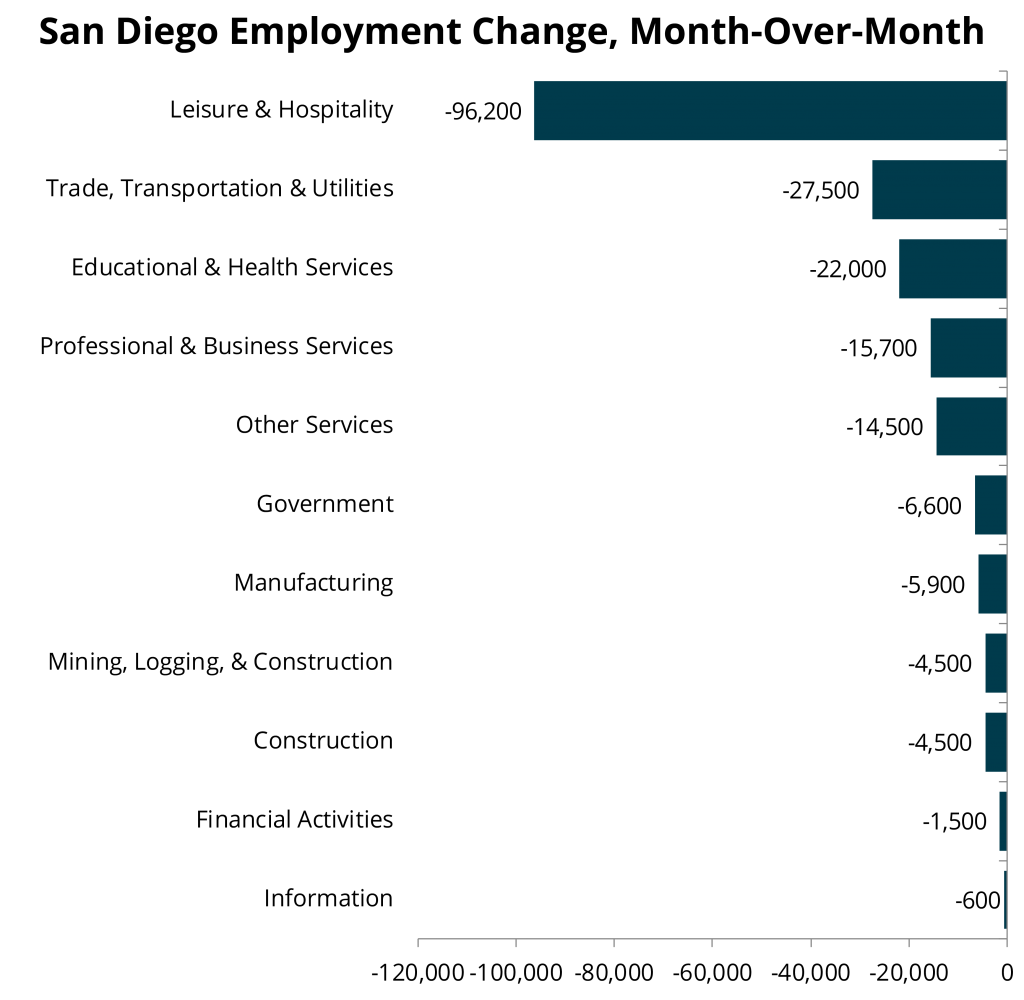

Sector Employment Suffers

Every one of San Diego’s 11 industry sectors lost jobs in April. Leisure and hospitality accounted for the lion’s share, shedding 96,200 payroll positions, or nearly 50 percent of its workforce. Within the leisure and hospitality sector, accommodation and food services lost 80,700 jobs, or 49 percent. California similarly saw widespread layoffs. Similar to San Diego, in California, leisure and hospitality posted the largest contraction at 866,200, which was more than double that of trade, transportation, and utilities, which gave up 388,700 payroll positions. This was also true nationally: job losses were spread across every industry, but cuts were especially severe in leisure & hospitality, which gave up some 7.7 million positions.

Retailers reduced employment by 20,300, or 14.3 percent in April, with the largest employment decreases in clothing and department stores. SANDAG estimates a potential loss of taxable retail sales of 53 percent in May, assuming a 3-month disruption from COVID19. This implies more retail job cuts could be on the way in the May employment report.

Understanding the ongoing economic damage caused by COVID19 can be daunting, as the numbers involved are often so far out of scale with the rest of historical data that it is difficult to even contextualize what they mean. Overall, COVID19 has accelerated unemployment and job losses at a level unheard of.