Every quarter San Diego Regional EDC analyzes key economic indicators that are important to understanding the regional economy and the region’s standing relative to the 25 most populous metropolitan areas in the U.S.

EDC explains San Diego’s Q1 2022 economic data:

Key Findings from Q1 2022:

- VENTURE CAPITAL: Strong VC funding in Life Sciences continues despite uncertainty surrounding inflation. Although high inflation and rising interest rates have been a concern recently, investments in Life Sciences companies only fell by about $10 million to $632 million from Q4, while investments in Tech companies returned to average levels. Total investment into the region exceeded $1 billion in Q1, an increase of more than $250 million compared to the quarterly average for 2019.

- COMMERCIAL REAL ESTATE: Demand for lab space has a greater impact on CRE market than remote work arrangements. As businesses embrace hybrid and remote work, there is uncertainty surrounding the impact to the commercial real estate market. Data show that businesses are not completely abandoning the office, with many adopting hybrid work schedules that will only lead to a one to two percent reduction in office space requirements nationally. In San Diego, demand from the Life Sciences industry is even stronger, resulting in a seven percent increase in asking rates for lab space from Q4. According to CBRE, 6.5 million square feet of planned conversions and construction are expected to become available in the next three years.

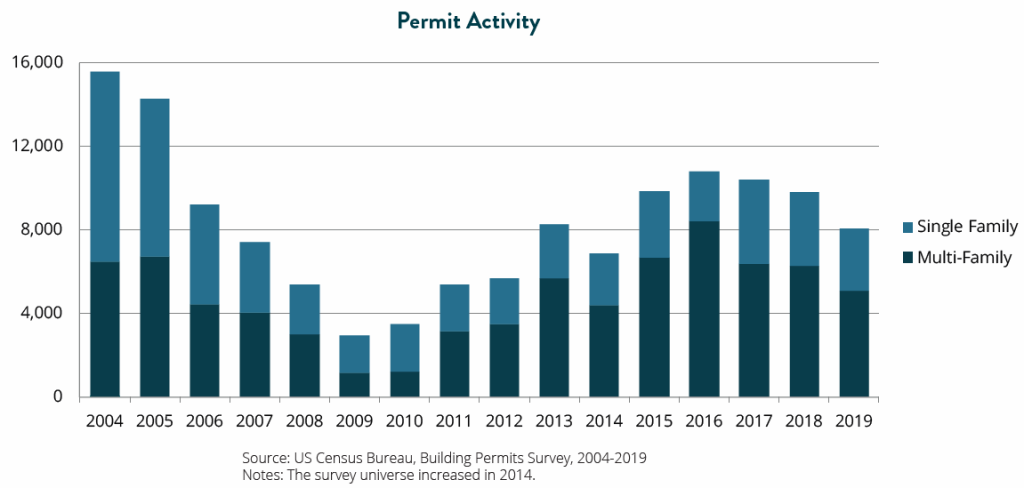

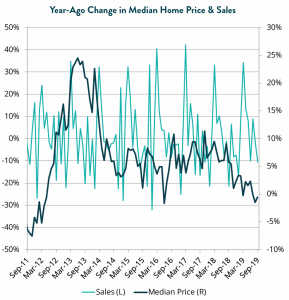

- HOUSING: Home prices continue to soar despite fewer sales. The median home price in San Diego continues to climb, reaching $950,000 in March. This translates to an 18.8 percent increase in the median home price compared to March 2021. In fact, the year-ago increase in home prices has hovered consistently around 15 percent since August 2021, almost double the rate of inflation we have seen over the past 12 months. While rising mortgage rates have the potential to temper the housing market, the median home price continues to rise at a faster rate than the national average.