EDC study assesses the economic impact of AI in Smart Cities

Today alongside underwriter Booz Allen Hamilton, San Diego Regional EDC released the fifth study in a series on the proliferation of Artificial Intelligence and Machine Learning (AI-ML) within San Diego County’s key economic clusters. “Designing the Future: Artificial Intelligence for Smart, Thriving Cities” explore the history and evolution of Smart Cities efforts around the world, and investigate whether these technologies can enable cities to be both more efficient and more inclusive.

By 2050, it is projected that more than two-thirds of the global population will reside in an urban area. This massive and rapid urbanization presents new challenges for cities around the world—San Diego included. Between 2010–2020, San Diego’s population increased 8.35 percent from 3 million to 3.3 million residents. As the region has grown, affordability, sustainability, and mobility have become major priorities for sustaining economic competitiveness and inclusion. AI-ML technology presents new opportunities, and new responsibility, for urban areas to unlock the potential of innovation to cultivate smart, thriving cities.

Underwritten by Booz Allen Hamilton, the web-based study—smartcities.sandiegoAI.org—includes San Diego case studies on use of AI-ML in Smart Cities, a ‘tour’ of Smart Cities efforts around the globe, and makes the business case for prioritizing economic inclusion in Smart Cities efforts, among other assessments.

“EDC’s AI series underscored that AI-ML adoption is creating new job opportunities, and the demand for these skills far outpaces the supply,” said Teddy Martinez, Senior Research Manager, EDC. “As we wrap with a focus on Smart Cities, it is clear that if done right, AI-ML also has the potential to advance economic inclusion and improve quality of life for more San Diegans.”

KEY FINDINGS

- AI-ML integration with Smart Cities efforts is still in the early stages. Smart Cities initiatives have evolved around the world from connected sensors and devices to promoting sustainability, efficiency, and mobility. Yet, local governments and businesses in San Diego have not yet fully integrated AI-ML into Smart Cities efforts.

- Demand for AI-ML talent is more than double the supply in San Diego. The region produced fewer than 3,000 AI-ML-related graduates in 2021, meanwhile, more than 7,800 local unique job postings required AI-ML skills in 2022.

- San Diego has above average concentrations in key industries that drive Smart Cities efforts, providing 50,454 jobs and an economic impact of $21.2 billion. Seven industries within the Professional, Scientific, and Technical Services sector also have the strongest appetite for AI-ML skills, responsible for one-in-four unique job postings in 2022.

- Moving from smart to thriving is the next chapter for technologically advanced cities. Smart Cities technologies have contributed to efficiencies, but do not yet drive economic growth. With greater intention, these technologies can improve affordability and quality of life, as well as support job growth and business expansion.

San Diego’s growing innovation economy has gotten rightful praise as a “World’s Smart City” by National Geographic, and recently as a “World Design Capital” alongside Tijuana. Home to established companies Booz Allen Hamilton and Qualcomm, or scaling startups like Kneron and Measurabl, the region is largely defying the ‘tech correction’ and experiencing massive growth to drive AI-ML innovation locally and beyond.

“Measurabl uses AI-ML to revolutionize how businesses approach energy management. By providing real-time insights about energy use and identifying areas of inefficiency, we empower our clients to make data-driven decisions that cut costs and reduce environmental impact—ensuring company ESG (environment, social, governance) goals are measurable, manageable, and auditable,” said Frank Pressel, Data Science and Data Engineering Manager, Measurabl, founded in San Diego.

“As a proud part of San Diego’s tech ecosystem, Booz Allen—with 1,300 employees in the region—is hiring in droves for roles in software development, AI-ML, data engineering, and computer engineering. Together with industry, research, and academia, San Diego has the ingredients to lead in a Smart Cities future,” said Joe Rohner, Vice President at Booz Allen Hamilton and a leader in the firm’s AI practice. “With the right integration and investments in AI-ML, our region can meet ambitious goals in sustainability, transportation, and inclusion. Developing the talent, and ensuring community buy-in, are critical to that success.”

The study series is underwritten by Booz Allen Hamilton and produced by EDC. Learn more about EDC’s research here.

read the report at smartcities.sandiegoAI.org

see the full ai series here

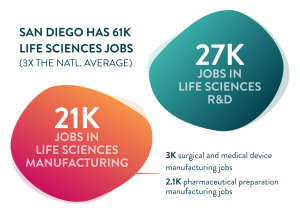

Life Sciences is an integral and rapidly growing piece of the San Diego regional economy. In 2021 alone, San Diego Life Sciences companies pulled in 13.1 percent of the $38.6 billion invested into Life Sciences nationwide. Supporting this growth, San Diego ranks fourth (4,300 in 2020) in Life Sciences degree completions among peer metros. Future and ongoing investment in Life Sciences companies and talent—most especially around compensation and accessibility—will ensure the longevity of this high impact industry and support its ability to compete.

Life Sciences is an integral and rapidly growing piece of the San Diego regional economy. In 2021 alone, San Diego Life Sciences companies pulled in 13.1 percent of the $38.6 billion invested into Life Sciences nationwide. Supporting this growth, San Diego ranks fourth (4,300 in 2020) in Life Sciences degree completions among peer metros. Future and ongoing investment in Life Sciences companies and talent—most especially around compensation and accessibility—will ensure the longevity of this high impact industry and support its ability to compete.