Welcome to the fourth edition in EDC’s Changing Business Landscape Series, which will be published bi-monthly in the San Diego Business Journal and here on our blog. If you missed them, check out the March, May, and July editions.

Surveying the changing business landscape in San Diego

The COVID-19 pandemic has impacted every facet of life, including how businesses operate. Companies in every industry are rapidly re-evaluating how they do business, changing the way they interact with customers, manage supply chains and where their employees are physically located. This has massive immediate and long-term implications for San Diego’s workforce and job composition, as well as regional land use decisions and infrastructure investment.

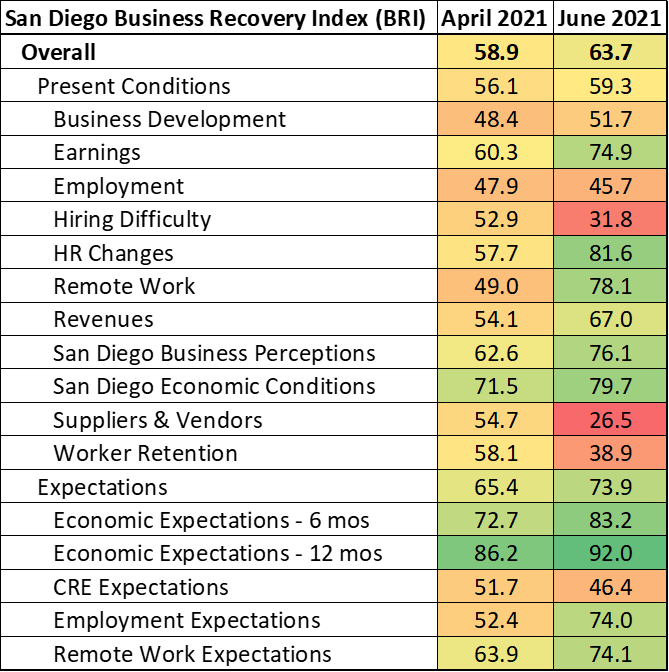

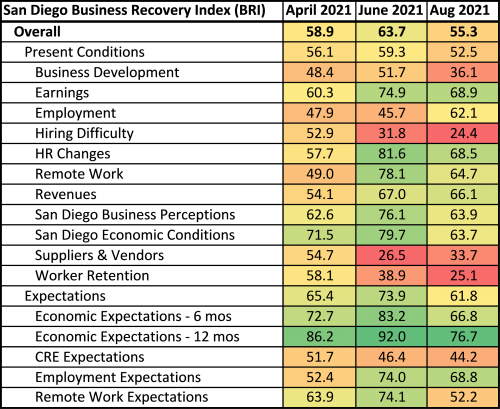

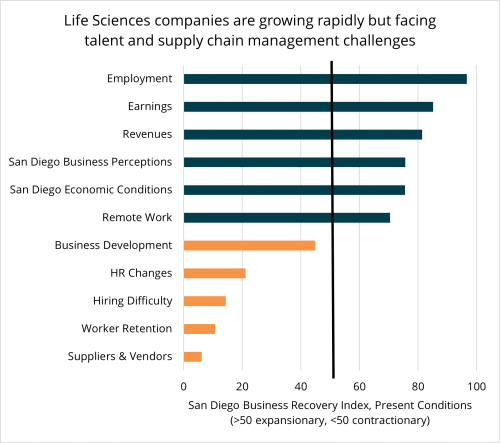

To identify evolving trends in local business needs and operations, ensuring their ability to grow and thrive in the region, San Diego Regional EDC is surveying nearly 200 companies in the region’s key industries on a rolling basis throughout 2021 to monitor and report shifts in their priorities and strategies. In addition, EDC constructed the San Diego Business Recovery Index (BRI)—a sentiment index to measure companies’ perceptions of current conditions, as well as expectations for the future across several factors such as business development, employment, and commercial real estate needs. (An index value >50 reflects expansion, and a value <50 reflects contraction. More information on the index and how it is calculated is available here.)

These insights will help inform long-term economic development priorities around talent recruitment and retention, quality job creation and infrastructure development. Companies are surveyed on several topics, with varying emphases in each wave.

Here are three key findings from the fourth wave of surveying conducted in August 2021:

- Life Sciences companies struggle to keep pace. Employers reported higher earnings and headcount but also increased difficulty attracting and retaining talent

- Supply chain disruptions hurt business development. The more profound impact of prolonged supply chain issues may be on San Diego business operations not local consumers.

- Remote work is driving companies to scale down office space. Life Sciences and Manufacturing are the exception, where rising sales and increased staffing will require companies to add space.

The BRI slid 8.4 points in August to settle at 55.3 after coming in at a solid 63.7 in June. August’s read suggests that the recovery could be slowing and reflects deteriorating views of present business conditions and slightly less upbeat expectations for the next six to 12 months.

All but two subindex values declined in August. The renewed challenges faced by businesses led many to temper their future expectations somewhat, though the expectations subindex remained comfortably in expansionary territory at 61.8. While companies still anticipate an improving local economy over the next six to 12 months, the economic expectations subindex for six months out fell 16.4 points from 83.2 in June to 66.8 in August. Meanwhile, the subindex for economic conditions 12 months out fell 15.3 points from an exuberant 92.0 to a more measured but still optimistic value of 76.7.

Life Sciences companies struggle to keep pace

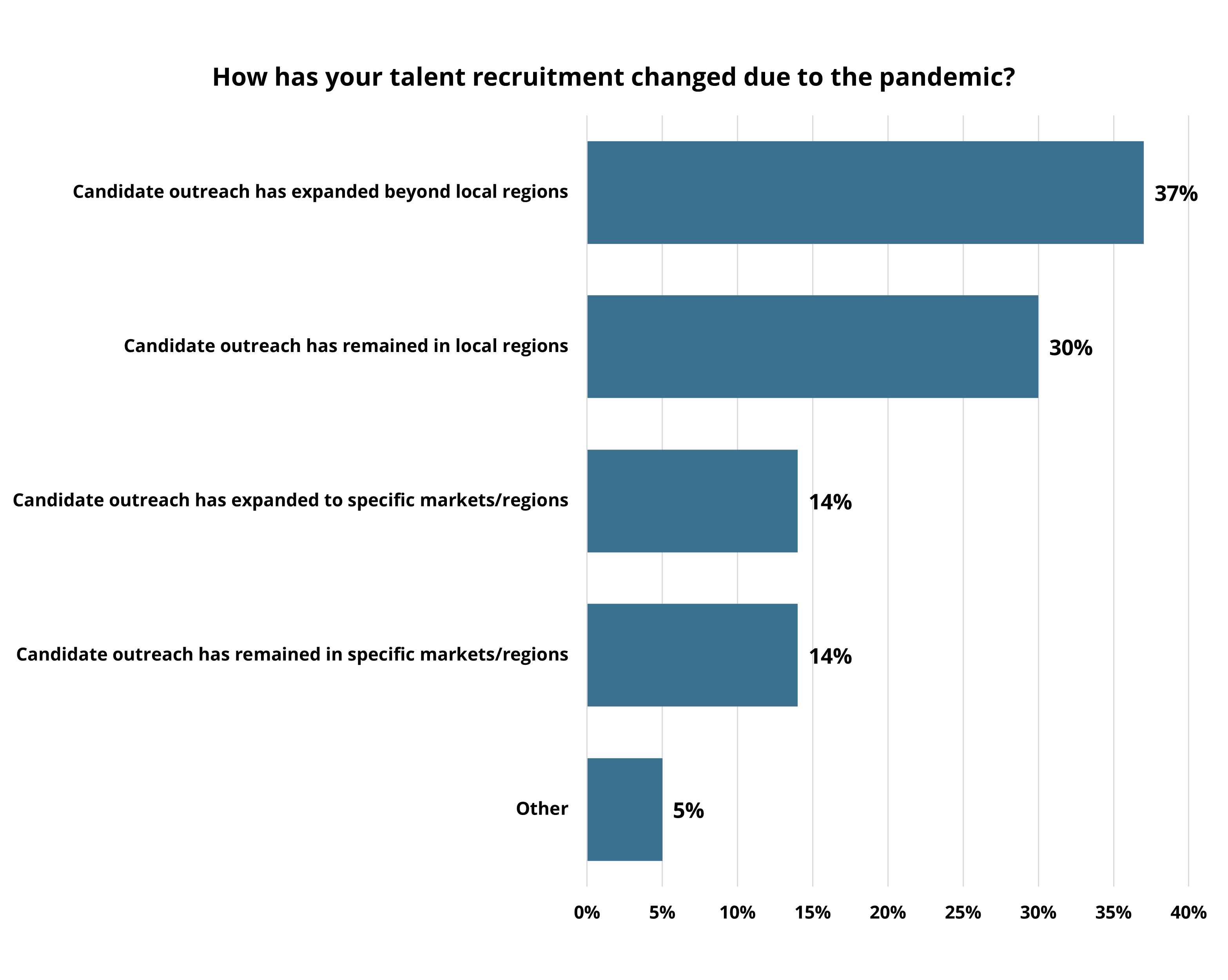

Employers surveyed reported an acceleration in hiring; the first time the employment subindex moved into expansionary territory. While this is welcome news, employers also reported increased difficulty hiring new workers. Though much attention has been given to the suggestion that extended unemployment benefits are keeping the unemployed from returning to work, the data doesn’t seem to support it. In fact, many of the pre-pandemic hiring trends have persisted and the industries having the hardest time filling jobs are those that are high-skill and high-paying. There were more than 118,000 unique job postings across the region during the month of August. The top job posting industries fall into the Tech and Life Sciences clusters and the most posted occupation was Software Developer (yet again).

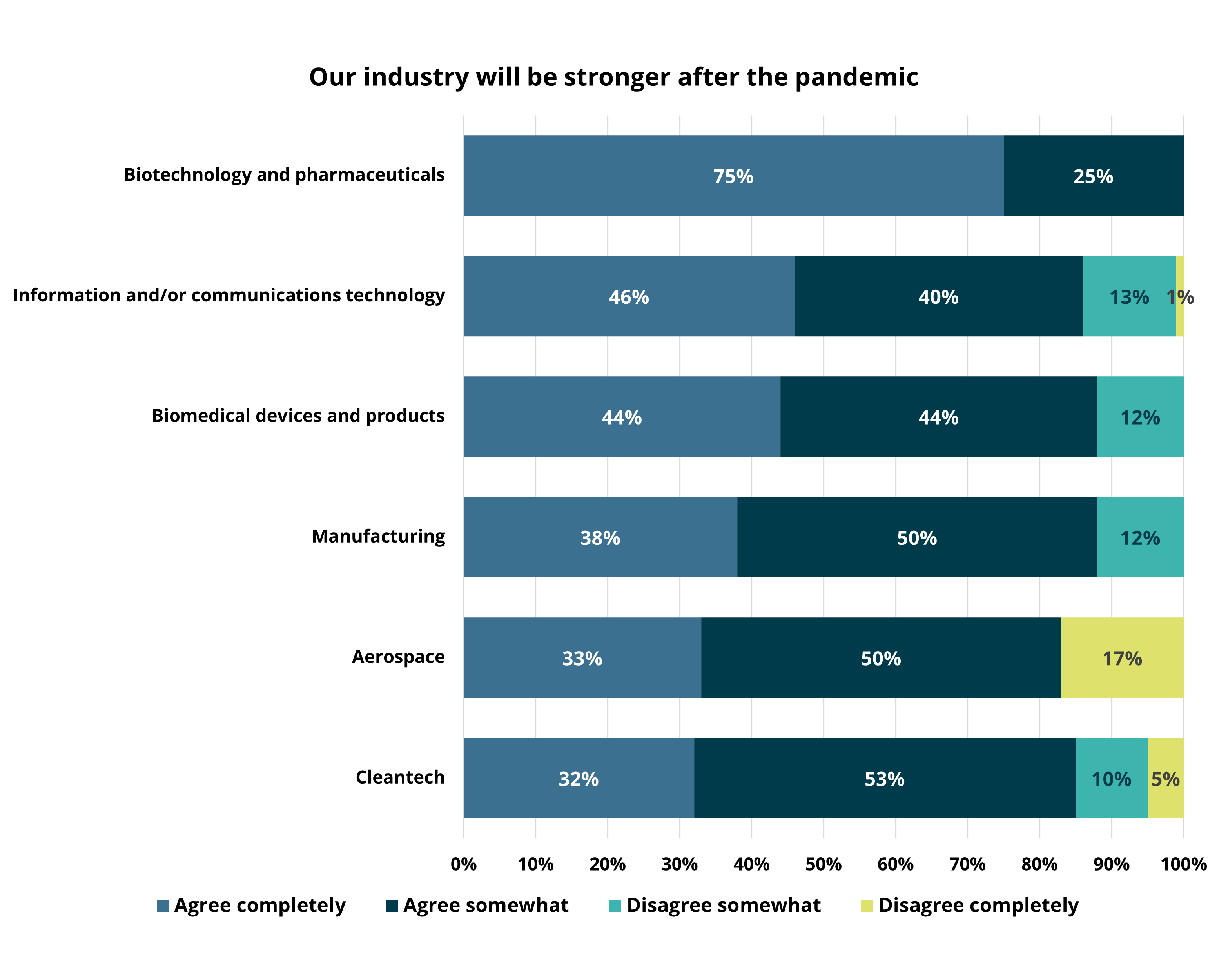

San Diego Life Sciences companies have been struggling to add talent fast enough. These companies have been at the forefront of developing treatments and producing medical devices aimed at combatting COVID-19. As such, they have grown rapidly, drawing more than $9 billion in venture capital funding since the pandemic began. While Life Sciences companies reported higher revenues, earnings and employment relative to before the pandemic began, they also report the greatest difficulties filling new positions, keeping their highly in-demand talent from competitors, and dealing with suppliers and vendors. Despite these challenges, most have great expectations for the year ahead, with plans for increasing staff, their physical footprint and remote work capabilities.

Supply chain disruptions hurt business development

One of the longest lasting impacts of the pandemic has been on global supply chains. Companies across the country remain light on inventory even as demand for goods from furniture and clothing to recreational goods and electric bicycles has jumped. In San Diego, consumer spending is now up 11 percent compared to February 2020 before any COVID-related shutdowns began. Many consumer goods are manufactured overseas, and as the Delta variant has spread in many parts of Asia, production has slowed or even halted. While supply chain disruptions may be affecting what San Diegans can buy and the prices they will pay, the more profound impact may be in what San Diego companies can sell and to whom.

Across all industries, San Diego companies noted continuing difficulties with managing suppliers and vendors. From Aerospace and Manufacturing to Software and Life Sciences, supply chain struggles have become more disruptive throughout the summer months. Upstream labor shortages have reduced production, port and travel delays led to late or canceled shipments, and the unavailability of microchips and plastics prevented companies from delivering finished goods and even services. This may help explain that while revenues and earnings are up, new business development is becoming increasingly difficult for companies surveyed, with the subsegment BRI falling sharply into contractionary territory of 36.1 in August from 51.7 in June.

These delays and disruptions not only hurt the companies that depend on raw materials and intermediate goods, they also directly impact the more than 54,000 people employed in San Diego’s Transportation and Logistics value chain. Furthermore, supply chain disruptions to San Diego companies hinders their ability to serve customers across the world. San Diego is a top 10 services-exporting metro, specializing in Professional, Scientific, and Technical Services like Research and Development (R&D), Cybersecurity, Engineering, and Software. These industries have massive impacts on the local economy with each 100 direct jobs supporting 200 more elsewhere in the region.

Remote work is driving companies to scale down office space

After more than 18 months of remote work, with multiple fits and starts to get back into the office, many companies are coming to terms with some form of permanent remote work for their staff. The high levels of efficiency gains reported in the June survey has since subsided but remain net positive and strongly so. Employers are not necessarily looking to further expand their remote work capabilities or adopt new technologies for remote work, but many report a high desire among their workforce to maintain remote work options. Several reports from across the country and industry show that workers are primarily interested in flexible work arrangements that allow them to go into the office as needed while being able to manage their personal lives and avoid unnecessary commutes when possible. This flexibility is especially important to working parents facing unpredictable school and daycare disruptions as the Delta variant causes classrooms to temporarily shut down, sending their children back home.

With fewer workers in the office full time, more companies are making the decision to reduce their physical footprint. Many Technology and Software companies report difficulty justifying large, empty offices and thus plan to scale down significantly over the next year. Even companies in Education and Healthcare, that serve customers in-person, are moving back-office workers to either hybrid or fully remote work environments.

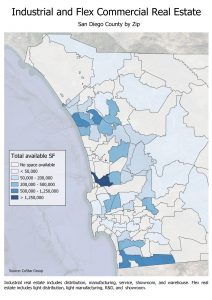

However, there are still companies looking to add space. These are mostly concentrated in Life Sciences and Manufacturing, where strong sales and increased hiring require more room to accommodate this growth. While many of these companies indicated plans to add office space, even more need industrial and lab space for R&D. Currently, there is almost 7.7 million square feet of industrial and flex space available and nearly 19 million square feet of office available across the region. The growing needs of companies suggests the balance may need to shift in the other direction.

Whether pharmaceuticals or beer, San Diego companies have long produced the things that make life more comfortable and more enjoyable. These companies also drive economic growth in our region. It is important that they have the assets they need, both in terms of physical infrastructure and skilled talent, to grow and thrive in San Diego.

Stay tuned for more on San Diego’s changing business landscape. EDC will be back every other month with more trends and insights. For more data and analysis visit our research page.

This research is made possible by: