Each month the California Employment Development Department (EDD) releases employment data for the prior month. This edition of San Diego’s Economic Pulse covers December 2020 and reflects some effects of the coronavirus pandemic on the labor market. Check out EDC’s Research Bureau for more data and stats about San Diego’s economy.

Key Takeaways

- San Diego lost 5,300 jobs, on net, in December, which is not typical during the holiday season.

- The unemployment rate jumped to 8.0 percent from 6.6 percent in November amid job losses and growth in the labor force.

- San Diego’s “K-shaped” recovery will exacerbate longstanding structural problems in the economy, making the case for an inclusive growth strategy even stronger.

Labor Market Overview

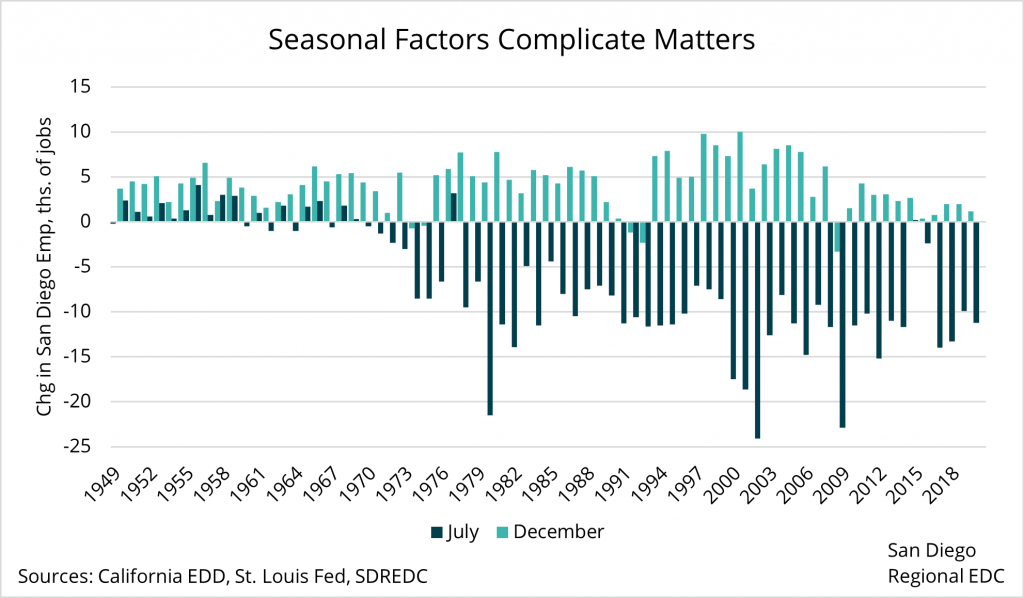

San Diego’s labor market suffered a setback in December after new business restrictions were put into place to combat a surge in COVID-19 infections and an alarming decline in ICU bed capacity. Local employers let go of 5,300 workers, on net, last month, lifting the unemployment rate to 8.0 percent from 6.6 percent in November. A drop in employment for the month of December is atypical, since holiday hiring is usually in full swing. Last month’s decline marks only the sixth time in 72 years where employers have let more workers go than they hired in December.

San Diego’s unemployment rate is lower than California’s 8.8 percent but significantly higher than the nation’s rate of 6.5 percent in December.

The causes for the rise in San Diego’s December unemployment rate are two-fold, and the news isn’t entirely bad: First, and most obviously, job losses drove the rate higher. However, this was compounded by an increase in the labor force of 12,200 people. The labor force vacillated for most of 2020 but ended the year close to its February, pre-pandemic level—good news for the labor market heading into 2021, if it is sustained.

Industry View

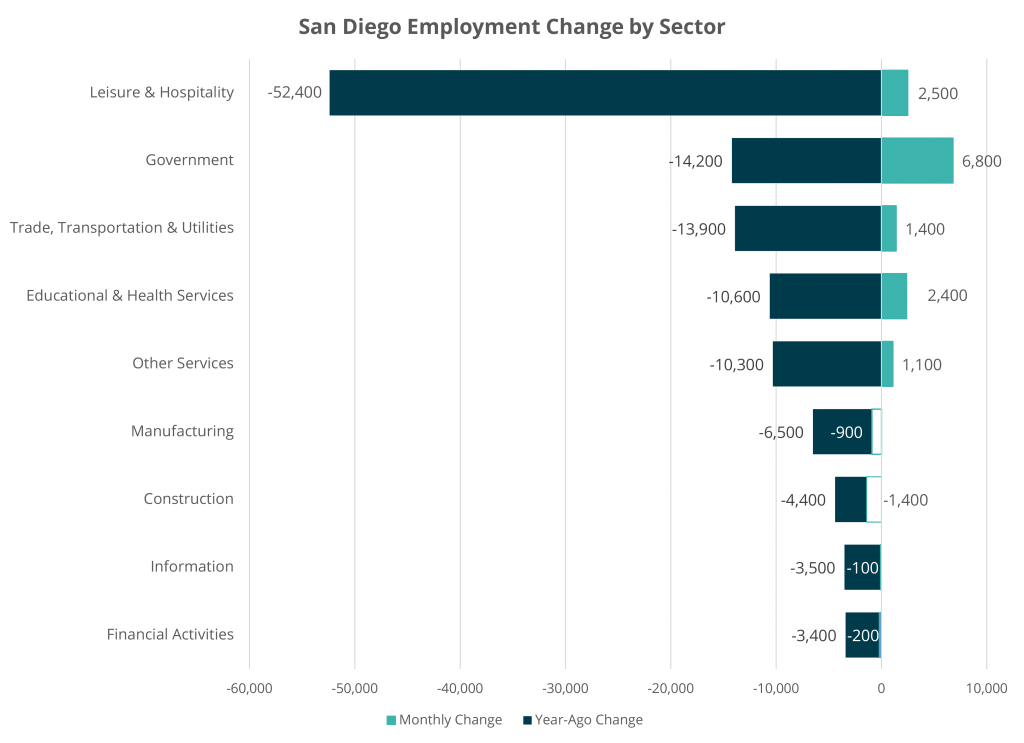

Leisure and Hospitality employers let go of 9,600 workers in December, which was more than enough to lower total employment. The lion’s share of hospitality job losses came from Accommodation and Food Services, which gave back 10,300 positions. Other Services, Government, Manufacturing, Educational Services (private, non-government), and Financial Activities each lost jobs. However, the losses for all of those industries totaled just 4,300, less than half of the layoffs experienced in Accommodation and Food Services alone.

The weakness in Leisure and Hospitality drove an even larger wedge between the jobs recovery for high-paying and low-paying positions, exacerbating a worrisome trend where the income and wealth gaps in San Diego will likely widen exponentially as a result of the pandemic-fueled recession.

Despite the decline in topline employment, job gains were apparent in a number of industries. Business and Professional Services added a healthy 2,500 workers in December, fueled by a gain of 2,700 in the crucial Professional, Scientific, and Technical segment, while retailers brought on 1,900 additional employees despite weak retail sales.

Behind the Numbers

All in all, December’s lackluster employment report is a downer, but not an unexpected one. With COVID-19 cases surging in the region and hospitals running out of valuable space for patients, business restrictions became necessary from a public health perspective.

As mentioned, the decline in employment last month is not typical for December, but it may bode well for January’s employment report. Under more normal circumstances, January typically reveals job losses as seasonal workers are let go. However, given that seasonal hiring was more tepid in 2020, layoffs in January may be less pronounced.

Labor force growth in December is also encouraging if it can be sustained. The extension of federal emergency unemployment benefits should help to keep a floor under the workforce, since only people in the labor force can claim them. Additionally, despite the sharp drop in Leisure and Hospitality employment last month, many firms in the region are still hiring. Therefore, we can expect people to remain in the labor force as long as job growth resumes as we enter 2021.

Unfortunately, these are about the only silver linings in December’s jobs report.

Annual revisions to the 2020 jobs numbers will be released by California EDD on Friday, March 12. Typically, revisions show greater job losses than were initially reported during recession periods. This is because the Labor Department estimates the pace of business formations in a given month, which usually assumes the addition of at least some new jobs as new firms come online. However, a Census-like count of business formation carried out after the initial estimates are released usually shows more business closures, on net, which thereby reduces the level of employment. So, in all likelihood, 2020 revisions could reveal deeper job losses last year than initially reported.

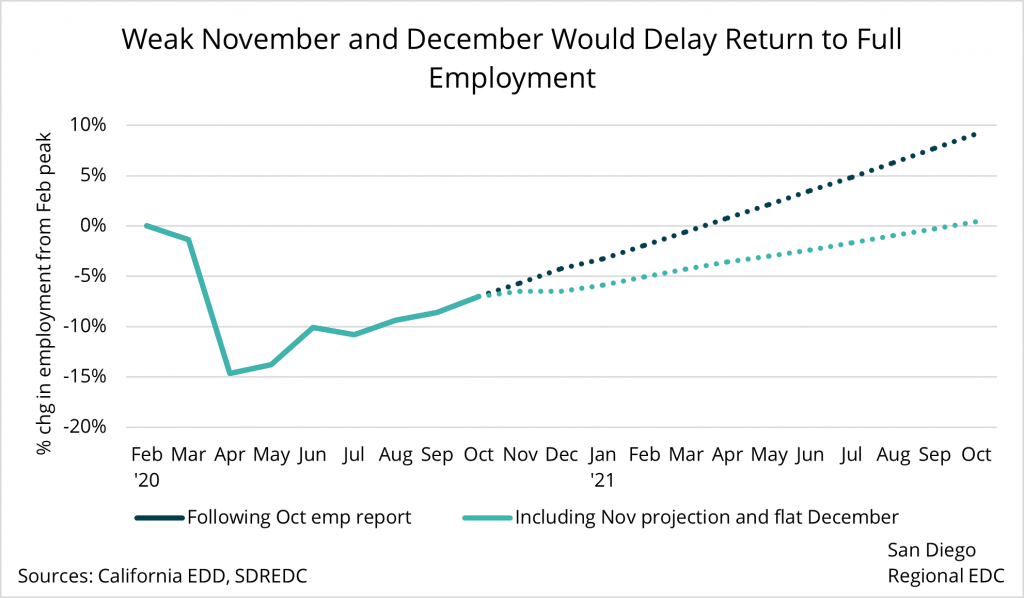

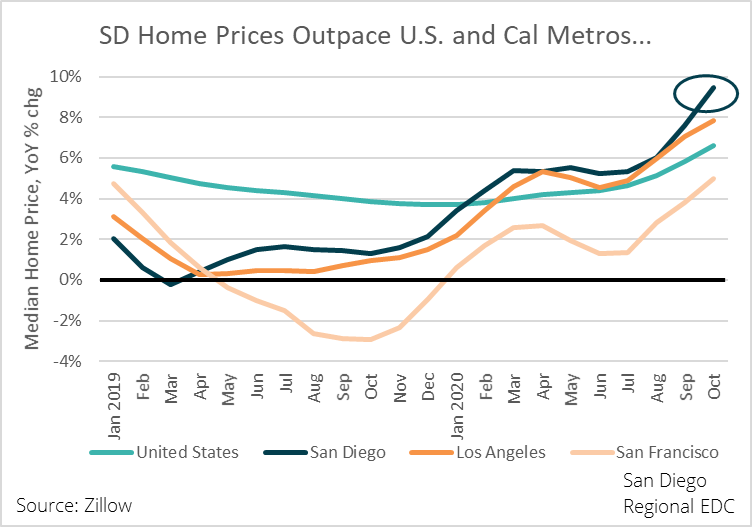

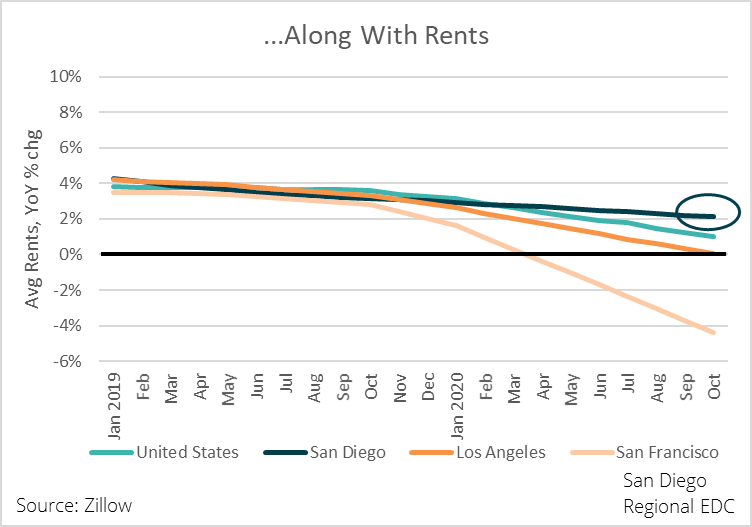

The shape and timbre of the jobs recovery means that even more work will be needed to shore up the local economy. The exponential widening in wealth and income gaps from the “K-shaped” recovery to-date will mean even more aggressive policies aimed at protecting and empowering our lowest-paid workers. Also, declines in the labor force earlier in 2020 were in large part the result of women leaving the workforce. If 2021 exhibits a repeat of that contraction, then it will almost certainly lead to greater disparities in gender pay. Finally, housing has continued to become even less affordable amid high unemployment and rising home values across the region.

It will take intentional and effective action to get this recovery right. It is now more important than ever to ensure greater access to higher education and worker training for our region’s lower-income households. Additionally, companies may also want to consider employee-ownership models, like the one Taylor Guitars recently announced, to give workers a larger stake in their economic fortunes. By offering a pathway to higher paying, more stable employment, we can ensure a more resilient and vibrant San Diego in the future, which will benefit all of us for decades to come.

Learn more about San Diego’s right recovery

You might also like to read:

- 7 COVID-19 resources for small businesses – January 2021

- Economy in crisis: Structural challenges will persist after economy recovers

- Economy in crisis: Job growth slows as we head into New Year

- Economy in crisis: SD housing market advances, but geographic differences remain

- San Diego’s Economic Pulse: November 2020